In the second week of November, average prices in most major European electricity markets exceeded €100/MWh, although they were lower than the previous week. This decrease occurred thanks to the increase in wind energy production and despite gas prices rising and registering the highest values of 2024. Even so, the Iberian and French markets registered the highest daily price of this year. Photovoltaic energy in Portugal surpassed the production record for a day in November. Demand increased in most markets, CO2 futures rose and Brent futures fell.

Solar photovoltaic and wind energy production

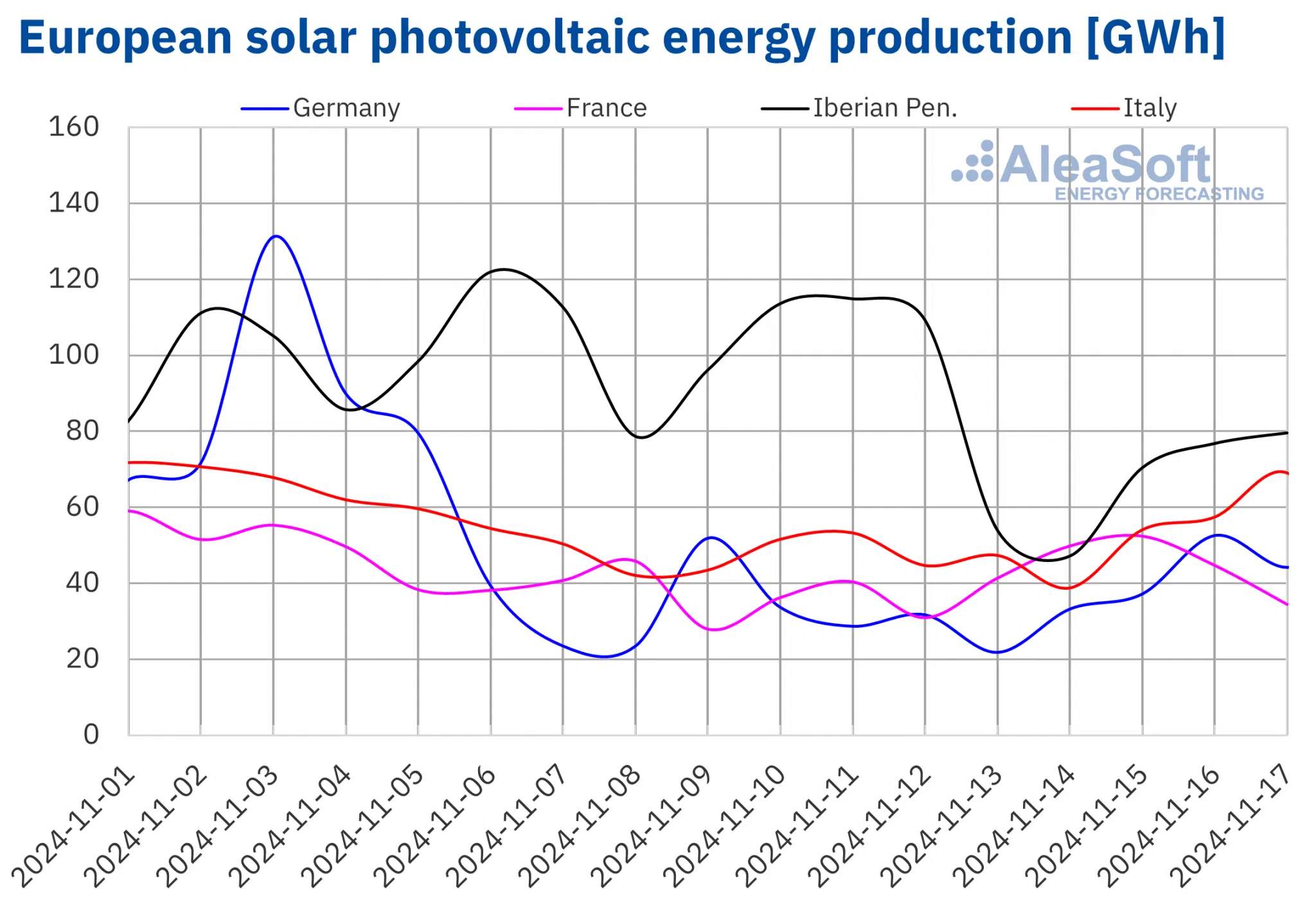

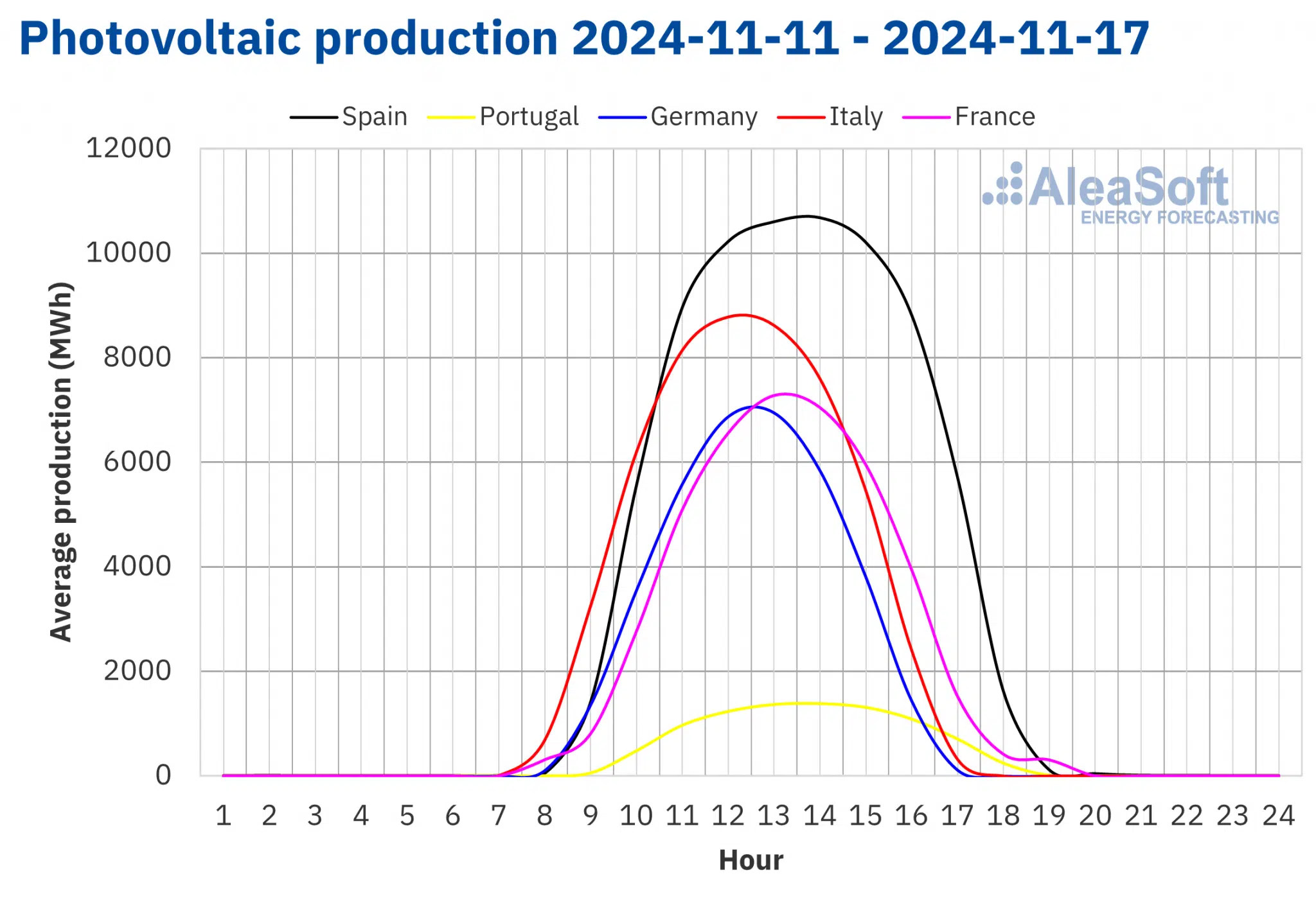

In the week of November 11, solar photovoltaic energy production increased compared to the previous week in the Italian and French markets by 0.3% and 6.2%, respectively. However, the markets of the Iberian Peninsula and Germany registered declines in production with this technology. The German market registered the largest decline, 27%, and maintained the downward trend for the fifth consecutive week. The Portuguese market registered the smallest drop, 7.4%, while the Spanish market registered a decline of 23%.

Despite the decline in solar photovoltaic energy production during the week in the Portuguese market, on Monday, November 11, this market reached the highest historical daily production for November, with 14 GWh. On the other hand, the French market registered the third highest value for November, with 52 GWh reached on Friday, November 15.

For the week of November 18, AleaSoft Energy Forecasting’s solar energy production forecasts predict increases in the German and Spanish markets, while solar energy production will decrease in the Italian market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

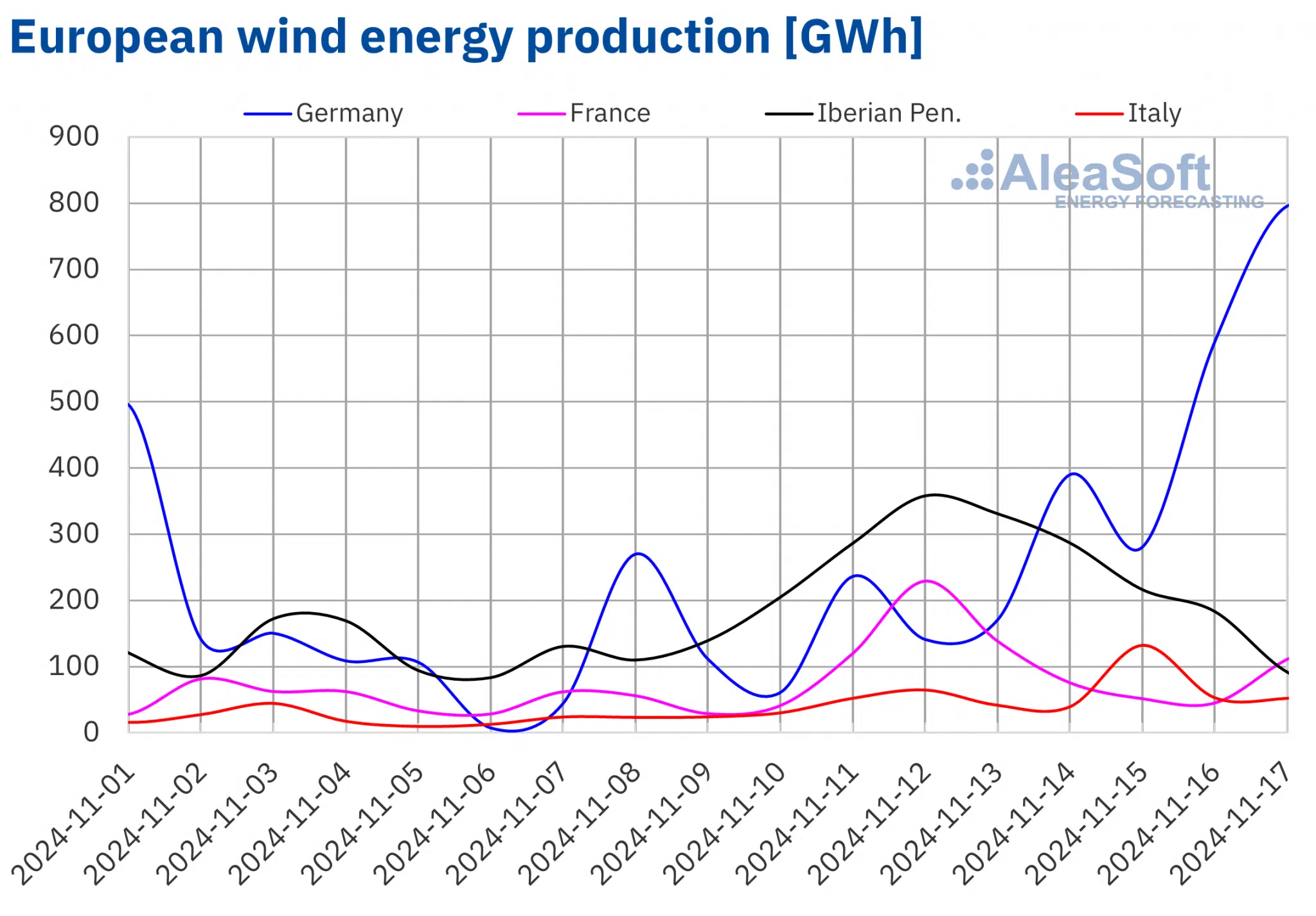

In the second week of November, wind energy production increased in all major European markets, following declines in the previous week. The German market registered the largest increase, 267%, followed by the rises in the Italian market, 209%, and the French market, 147%. On the other hand, the Iberian Peninsula markets experienced the lowest growth, reaching 83% in Portugal and 90% in Spain.

For the third week of November, AleaSoft Energy Forecasting’s wind energy production forecasts indicate increases in production with this technology in most analyzed European markets, except in the Portuguese market, where it will decrease.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

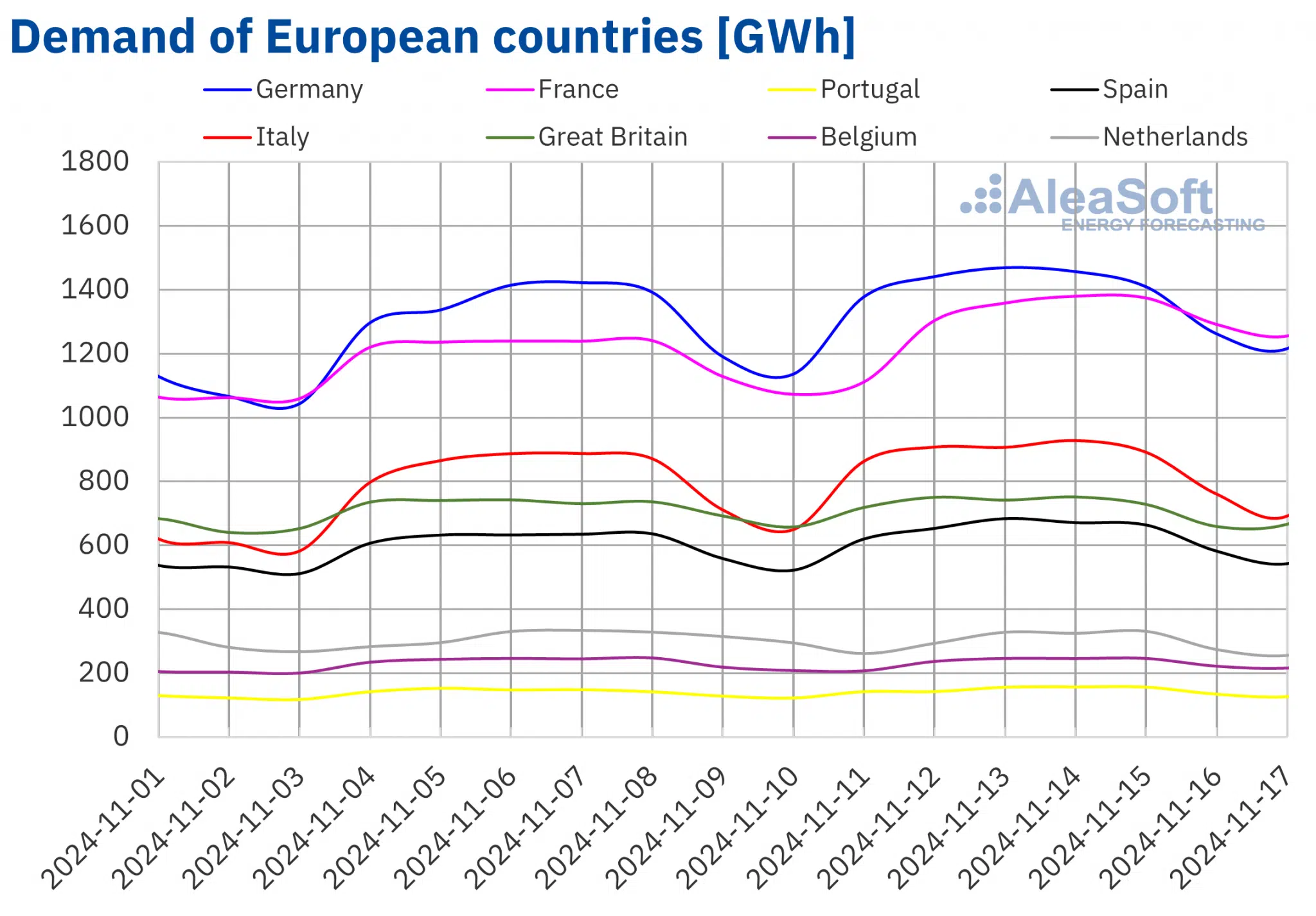

Electricity demand

During the week of November 11, electricity demand increased in most major European electricity markets compared to the previous week. The French market registered the largest increase, 8.3%, and maintained its upward trend for the fourth consecutive week. The Portuguese, Spanish, German and Italian markets registered increases for the second consecutive week, with values ranging from 3.2% in Portugal to 4.9% in Italy. On the other hand, the markets of the Netherlands, Belgium and Great Britain registered a downward shift. The Dutch market registered the largest decline, 5.2%, while the British and Belgian markets had declines of 0.4% and 1.4%, respectively.

Average temperatures fell in most analyzed markets. The Iberian Peninsula showed the largest drop in average temperatures, with a decrease of 3.1 °C, while Germany registered the smallest drop, 0.1 °C. Great Britain, France and Italy registered decreases, ranging from 0.9 °C in Great Britain to 3.0 °C in Italy. On the other hand, in Belgium and the Netherlands, average temperatures increased by 1.6 °C and 2.1 °C, respectively.

The November 11 holiday, Armistice Day, celebrated in Belgium and France, combined with less cold average temperatures in Belgium, led to reduced demand in this market. In the French market, lower average temperatures during the week led to an increase in demand, despite the reduction in work activity during the holiday on Monday.

For the third week of November, AleaSoft Energy Forecasting’s demand forecasts indicate that demand will increase in most major European electricity markets, except in the Iberian Peninsula and Germany, where it will decrease compared to the previous week.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

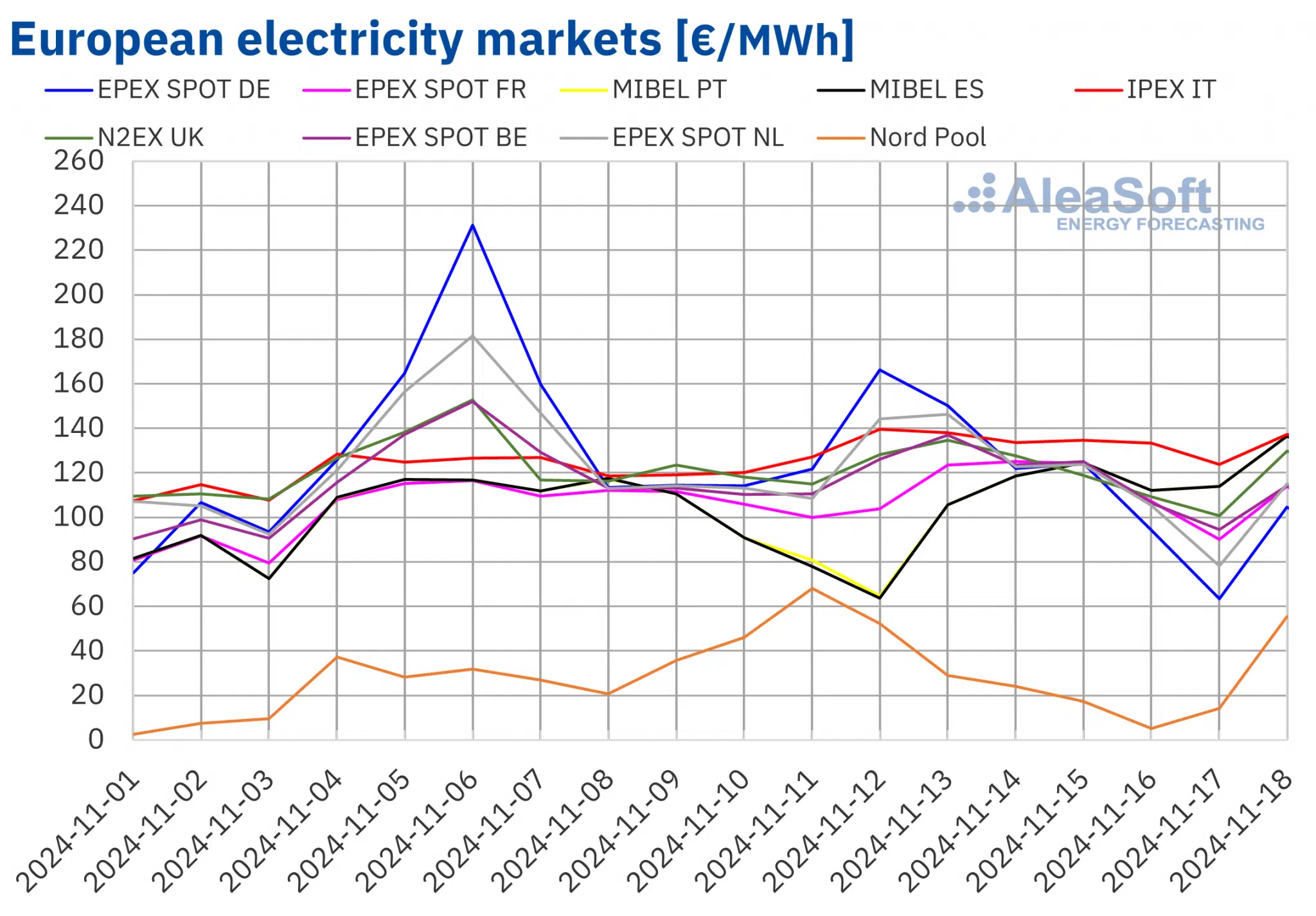

In the second week of November, average prices in most major European electricity markets fell compared to the previous week. The IPEX market of Italy was the exception, with a rise of 7.6%. The EPEX SPOT market of Germany reached the largest percentage price drop, 18%, following the high prices registered the previous week, when prices even exceeded €800/MWh for a couple of hours. In contrast, the EPEX SPOT market of France registered the smallest drop, 0.7%. In the other markets analyzed at AleaSoft Energy Forecasting, prices fell between 5.5% in the Belgian market and 12% in the Dutch market.

In the second week of November, weekly averages continued to be above €100/MWh in most analyzed European electricity markets. The exception was the Nord Pool market of the Nordic countries, which registered the lowest weekly average, €30.00/MWh. In contrast, the Italian market reached the highest weekly average, €132.84/MWh. In the rest of the analyzed markets, prices ranged from €102.37/MWh in the MIBEL market of Spain to €120.29/MWh in the German market.

Regarding daily prices, on Monday, November 11, the Nordic market reached its highest price since April 27, 2024, which was €68.17/MWh. On Thursday, November 14, the French market registered a price of €125.10/MWh, the highest in this market since December 7, 2023. In the case of the Spanish and Portuguese markets, on Monday, November 18, the price was €136.37/MWh, which was their highest price since October 17, 2023.

During the week of November 11, despite the increase in weekly gas and CO2 emission allowance prices and the increase in demand in some markets, the significant increase in wind energy production led to lower prices in the European electricity markets. In the case of the Italian market, although wind and solar energy production increased, its dependence on gas for electricity generation and the increase in demand contributed to the price increase.

AleaSoft Energy Forecasting’s price forecasts indicate that, in the third week of November, prices will continue to fall in most major European electricity markets. The increase in wind energy production in most markets will favor this behavior. In the case of the German and Spanish markets, the increase in solar energy production and the decrease in demand will also contribute to lower prices. However, prices could increase in the N2EX market of the United Kingdom, where the largest increase in demand is expected.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

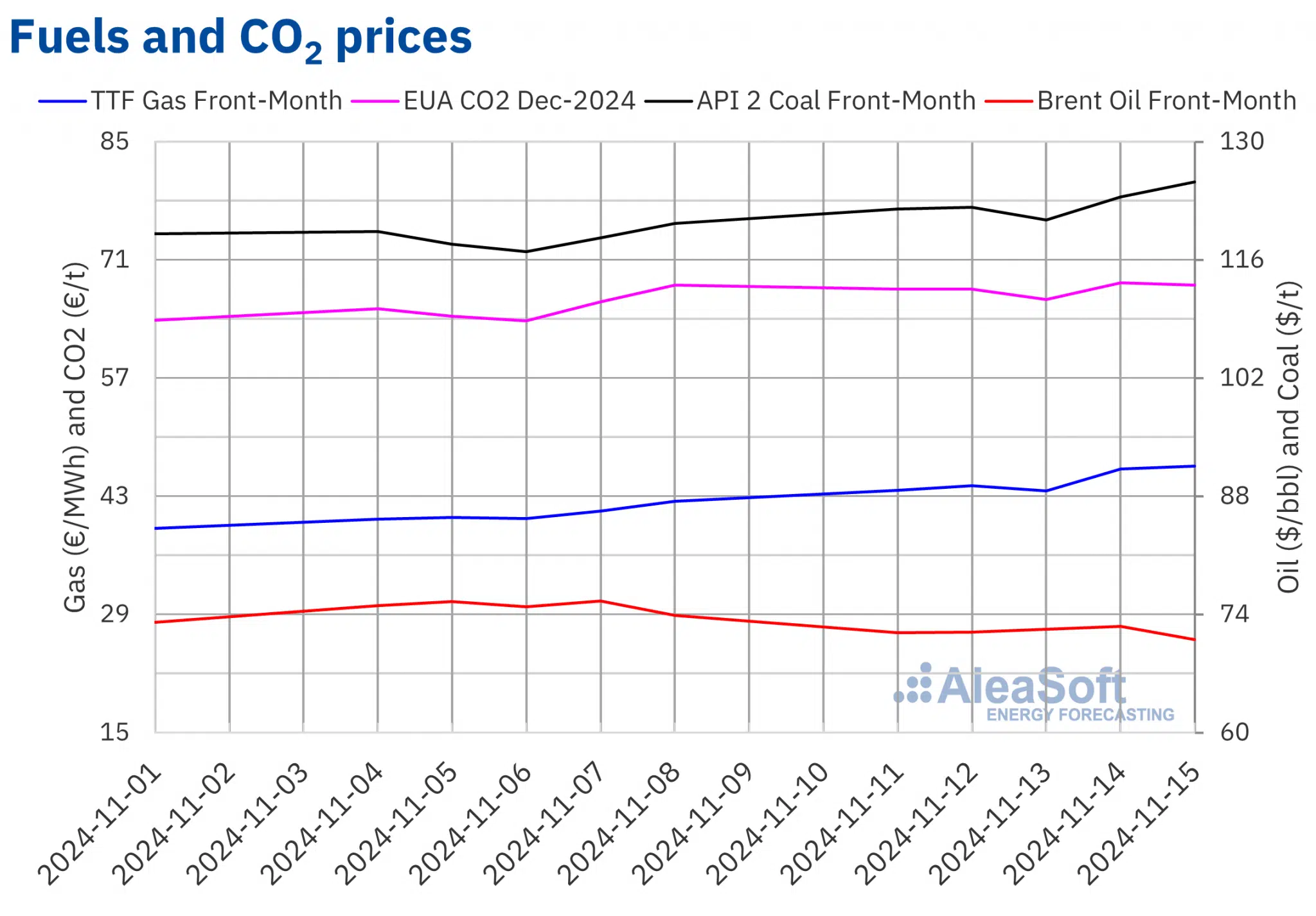

Brent, fuels and CO2Brent oil futures for the Front?

Month in the ICE market began the second week of November with a 2.8% decline from the last session of the previous week, registering a settlement price of $71.83/bbl on Monday, November 11. Subsequently, prices increased slightly and on Thursday, November 14, these futures reached their weekly maximum settlement price, $72.56/bbl. However, on Friday, November 15, there was a 2.1% decline from the previous day. As a result, these futures registered their weekly minimum settlement price, $71.04/bbl. According to data analyzed at AleaSoft Energy Forecasting, this price was 3.8% lower than the previous Friday and the lowest since September 12. For the week as a whole, the average of the settlement prices fell by 4.1% compared to the previous week.

In the second week of November, OPEC lowered its oil demand growth forecasts for 2024 and 2025. The International Energy Agency also lowered its forecasts for 2025. In the case of global demand forecasts for 2024, the International Energy Agency increased its forecasts from those of October, although they remained lower than those of OPEC. Concerns about demand evolution in China continued in the second week of November. Expectations of lower interest rate cuts in the United States, as well as the strength of the dollar, also put downward pressure on the prices of these futures.

As for settlement prices of TTF gas futures in the ICE market for the Front-Month, they increased in almost all sessions of the second week of November, except on November 13. On that day, these futures reached their weekly minimum settlement price, €43.67/MWh. In contrast, as a consequence of the increases, on Friday, November 15, these futures registered their weekly maximum settlement price, €46.55/MWh. According to data analyzed at AleaSoft Energy Forecasting, this price was 9.8% higher than the previous Friday and the highest since November 25, 2023.

The rise in gas prices registered in the first half of November has been influenced by the fact that, although European gas reserves remain high, they have started to empty earlier than last year, raising concerns about the impact this could have on the refilling process to face the summer of 2025. In addition, forecasts of low temperatures supported higher TTF gas futures prices in the second week of November. Concerns about the possible disruption of gas supplies from Russia via Ukraine as of December 31, as well as the disruption of Russian gas supplies to Austria since November 16, also contributed to the price rise.

Regarding CO2 emission allowance futures in the EEX market for the reference contract of December 2024, they started the second week of November with price declines. These declines continued until November 13. On that day, these futures registered their weekly minimum settlement price, €66.31/t. However, after a 3.0% increase from the previous day, on Thursday, November 14, these futures reached their weekly maximum settlement price, €68.27/t. According to data analyzed at AleaSoft Energy Forecasting, this price was the highest since September 3. On Friday, November 15, prices fell again to €68.01/t. That settlement price was only €0.01/t lower than the previous Friday. Despite the declines, the weekly average was 3.2% higher than the previous week.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and energy storage

On Thursday, November 14, AleaSoft Energy Forecasting held the 49th webinar of its monthly webinar series. The webinar featured the participation of Luis Marquina de Soto, president of AEPIBAL, the Business Association of Batteries and Energy Storage. On this occasion, the webinar analyzed the evolution and prospects of European energy markets for the winter of 2024?2025, as well as the prospects for batteries, hybridization and energy storage. In addition, AleaSoft services for battery and hybridization projects were explained.