Illustration; Source: International Energy Agency (IEA)

The first edition of the ‘State of Energy Policy’ report looks into the key measures that have been adopted across several countries or regions and shows potential to progress the clean energy transition. Intended as a ‘first-of-its-kind’ global inventory, the 2024 issue covers international commitments and climate pledges, government energy spending, trade policies, and regulations by countries and sectors.

The report delves into the types of policies governments use to meet their commitments while ensuring energy security, and where these policies have caught on. This includes the Energy Policy Inventory, a publicly available repository containing over 5,000 energy-related policies worldwide across areas such as government spending, regulation, and trade.

The report states that the last four years saw a wave of new energy policies addressing the pressing energy security concerns and enhancing the uptake of clean energy. As a result, clean energy investment has grown 60% globally since 2020.

“The unprecedented level of policy and investment support for clean energy is a recognition that these technologies not only reduce emissions but help safeguard energy security,” said Laura Cozzi, IEA Director of Sustainability, Technology and Outlooks. “The increase in trade policies and domestic manufacturing incentives also signals that clean energy is becoming central in industrial policies.”

Climate goals reach new heights amid security of supply woes

The COVID-19-induced economic crisis prompted governments to introduce mitigation measures, with many prioritizing clean energy transition. Close to 150 countries – covering nearly 95% of global greenhouse gas (GHG) emissions – presented more ambitious climate goals, with one-third of them tightening energy efficiency, renewables, and emissions standards, the report asserts.

Another element in the policymakers’ shift to energy security was Russia’s invasion of Ukraine in 2022, which caused energy prices to skyrocket, exposing the risks posed to interconnected energy systems. Traditional energy security concerns reemerged and new ones appeared, particularly in terms of supply chain concentration of key technologies and the critical minerals needed for their production.

Factors additionally complicating the situation included disruptions to trade routes due to growing geopolitical tensions and climate change-induced extreme weather. Based on the report, countries are increasingly adopting balancing approaches to interconnected goals of sustainability, affordability, competitiveness, and security.

As the situation stabilized, the downturn in prices – especially natural gas, whose 2024 price was nearly 50% lower than the level witnessed in 2023 – brought a new set of challenges for energy giants such as Eni, Equinor, BP, and TotalEnergies, which registered drops in profit.

Government-funded low-carbon and green plays on the rise

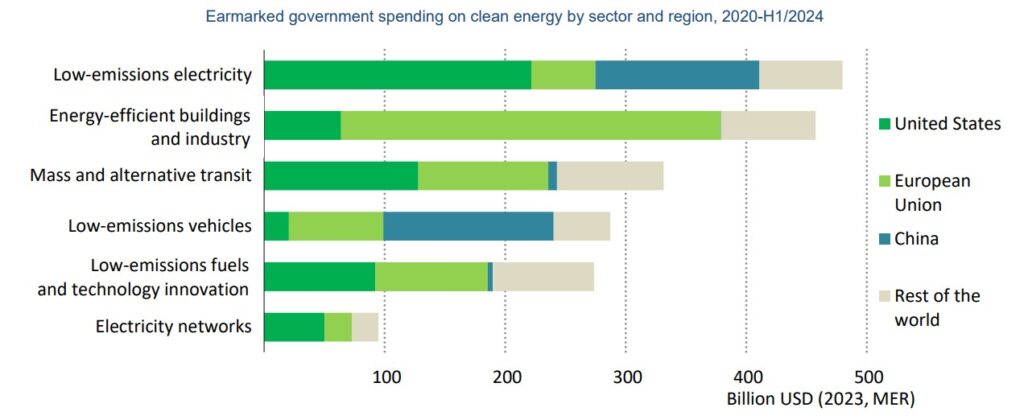

The inaugural report shows that government incentives for clean energy tripled compared to the amount allocated in response to the 2007–08 financial crisis, reaching $2 trillion since 2020. Some 80% of this is concentrated in China, the European Union, and the United States. New spending measures continue to be approved, with over 40 countries allocating $290 billion for clean energy support in the first half of 2024.

Earmarked government support for clean energy investment and consumer energy affordability measures by budget allocation year; Source: IEA

Government interventions to manage energy prices peaked in 2022 when total end-use expenditure on energy reached a record high of $10 trillion. Short-term consumer support directly from governments totaled $940 billion, mainly in Europe, while other pricing regulations instituted by governments amounted to $2.4 trillion in fossil fuel subsidies since 2022. Prices have since declined and governments have rolled back most emergency provisions.

The remaining subsidies have received criticism from environmental organizations, such as the United for Climate Justice (UCJ), which recently organized a protest in Brussels urging heads of EU institutions to put an end to state funding of fossil fuels. An open letter was delivered to EU leaders ahead of the protest, stating that subsidies “distort energy demand, perpetuate dependence on polluting energy sources, and undermine European energy security.”

As indicated in the report, securing clean energy supply chains has become a key priority, resulting in the introduction of various policy measures – from direct incentives to trade policy. However, the geographical concentrations within clean energy supply chains seem to be higher than fossil fuel supply, rendering global supply chains vulnerable to disruptions.

Wave of energy regulations steps up decarbonization

New energy regulations were passed in 35 countries – representing one-fifth of energy-sector CO2 emissions – since 2023. Some of the most notable updates to energy regulations highlighted in the IEA’s analysis are the latest fuel economy and emissions standards for passenger cars and trucks, as well as new regulations for GHG emissions from fossil fuel-fired power plants in the United States.

The European Union’s methane regulation is one such piece of legislation. The regulation is aimed at curbing direct methane emissions from oil, gas, coal, and biomethane, and member states are expected to start implementing it in 2025.

On the other hand, some policies have been rolled back since 2020, notably the proposed regulations banning the sale of new fossil fuel boilers in buildings and of internal combustion engines (ICE) vehicles, and phasing-out of unabated coal. The replacement regulations either delayed the start date for compliance or relaxed the proposed policy stringency, the report states.

More action needed to curb methane menace

Other policies, however, imply some lag. For example, most fuel economy standards are updated every 4–5 years, aiming to give the industry a 10–15-year window to comply – but a lack of enforcement of these standards can reduce their impact. The IEA believes this is one of the reasons why energy-sector methane emissions went up by 3% last year even though regulations targeting methane slips now cover 90% of fossil fuel production.

While methane reductions are a top priority under the Paris Agreement, another report by IEA found that not only are additional efforts needed to meet the required energy targets, but curbing the fossil fuel industry’s methane footprint by 75% this decade could cost around $170 billion.

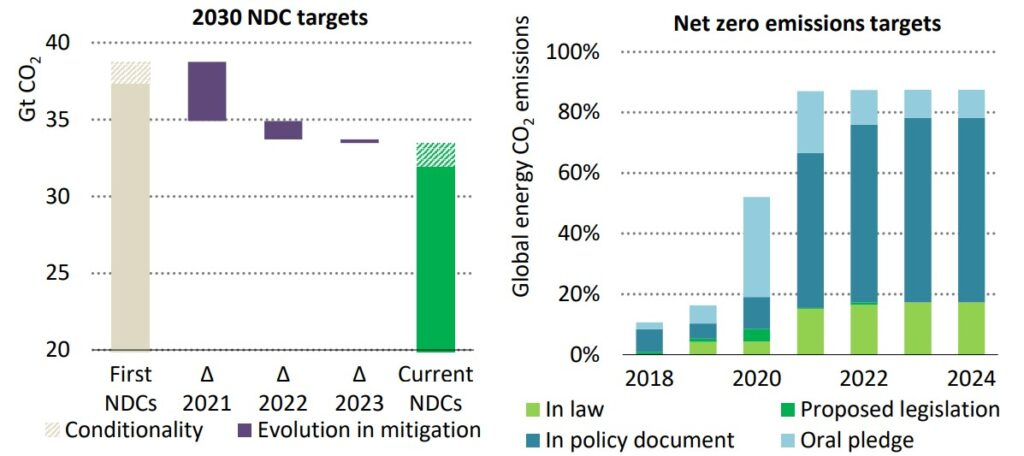

The latest report suggests that more action is also needed if nationally determined contributions (NDCs) are to meet the long-term climate objective of reducing CO2 emissions to 32 Gt by 2030. Since Paris Agreement signatories are expected to update the targets next year, the agency believes its report can help determine which policies have proven effective in this regard, and where they can be expanded.

Evolution in mitigation targets in Nationally Determined Contributions (NDCs) and coverage of net zero emissions targets; Source: IEA, Climate Pledges Explorer