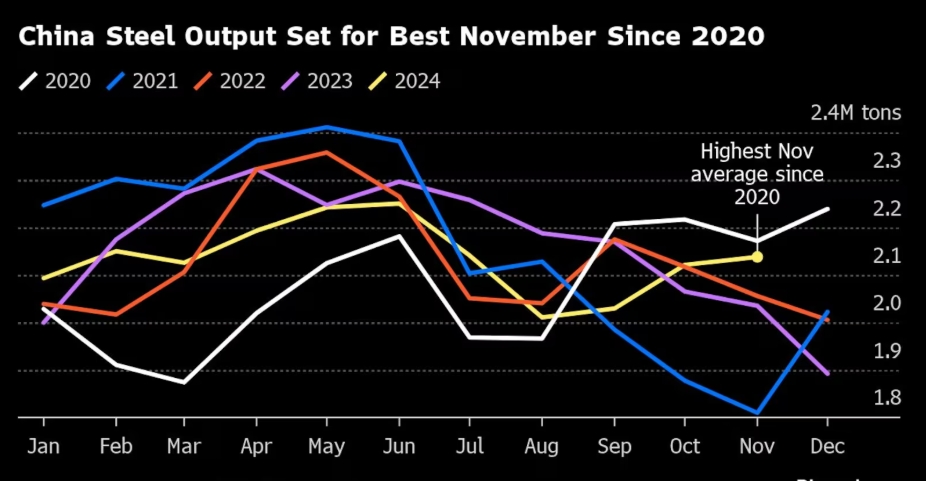

Average crude steel output in the first 20 days of November reached the highest for the time of year since 2020, according to data from the China Iron and Steel Association. That’s lifted iron ore futures by 2.5% this week, as mills procure more of the feedstock despite the persistent drag on demand from the country’s yearslong property crisis.

Production has risen because “China’s steel inventory level is low due to the production cuts in August and September,” said Steven Yu, a researcher at Mysteel Global. Profit margins at mills have also staged something of a recovery, he said. A recent Mysteel survey found that 55% of mills are profitable, after a collapse in margins earlier in the year.

Iron ore remains one of the worst-performing major commodities, losing more than a quarter of its value this year. China’s housing market is still reeling and government stimulus has so far had little impact on markets for construction materials, although hopes of further measures in coming months are at least offering some support.

“Production in this winter season might be busier than usual,” said He Jianhui, an analyst at SDIC Futures Co. “However, it won’t be a strong boost to market sentiment as demand is still bound to decline during these months.”

Iron ore futures rose 0.5% to $103.10 in Singapore as of 12:02 a.m. The market in Dalian, and steel futures contracts in Shanghai, also advanced.