The estimated levelised cost of green hydrogen (LCOH)—which includes both capital expenditure (capex) and operational expenditure (opex) per unit of production—is currently 1.75 times that of grey hydrogen and 1.50 times that of brown hydrogen. This disparity persists despite the waiver of interstate transmission charges (ISTS) for renewable power, and it remains a key barrier to the viability and widespread adoption of green hydrogen (GH2), says a new report by CareEdge Ratings.

The report states that a significant capex outlay of INR 2.40 lakh crore is required to produce one million metric tonnes (MMT) of GH2. Capex for renewable energy generation and capex for electrolyser are the two major cost components with an estimated contribution of 48% and 34%, respectively, in the overall project cost.

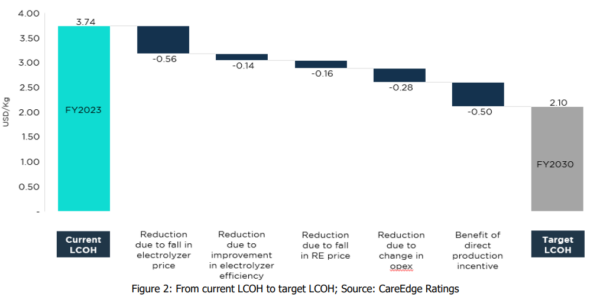

CareEdge Ratings estimates the LCOH at $3.74 per kg as of CY 2023 considering the waiver of interstate transmission charges. In the years ahead, it opines that reduction in electrolyser cost and efficiency improvement will be key to achieving a targeted levelised cost of $2.1/kg.

Additionally, production-linked incentives announced by the Government of India (GoI) such as a direct production incentive of up to $0.50/kg of GH2 production for the first two years and an incentive on electrolyser capex of $54/kW will help achieve the targeted LCOH.

“Given the limited headroom for reduction in renewable energy capex cost, lowering of electrolyser costs by 35-40%, improvement in efficiency by 12-14% and continued policy support are critical for achieving cost viability of GH2 to around $2.1 per kg. Technological advancement in the electrolyser manufacturing ecosystem, cost reduction in stack material and economies of scale shall be key drivers for cost reduction of electrolysers in future,” says Maulesh Desai, director, CareEdge Ratings.

“From the demand perspective, the absence of long-term offtake arrangement of GH2 would be the key issue for developers and lenders. Hence, incentivising downstream users of GH2 over the use of other alternatives would be critical for gradual migration towards GH2,” says Hardik Shah, Director, CareEdge Ratings.

As per the report, currently, refineries have a high market share of 43% in the overall hydrogen demand of six million metric tonnes in India. Further, the cost of hydrogen in the overall production cost of refineries is low, making refineries one of early users for green hydrogen.

“Refineries can lead to a potential demand of 2.70-3.00 million metric tonne (mmt) of GH2 over FY27-FY30. Ammonia can also be a probable early adopter for GH2 subject to the price parity of green ammonia with ammonia produced from natural gas. Adoption of green ammonia can lead to a potential demand of 3.75-4.25 mmt of GH2 over FY27-FY30, of which one-third demand may be from non-urea sector. Besides, green ammonia also holds significant export potential due to competitive renewable energy cost in India if the issue related to its storage and transportation is adequately managed, “says Hardik Shah, director, CareEdge Ratings.