John Bauer, director of North Dakota generation at Great River Energy, stands by a photograph of Blue Flint Ethanol and Great River Energy's Coal Creek Station. The two entities are collaborating on a carbon capture storage project.

John Bauer, director of North Dakota generation at Great River Energy, stands by a photograph of Blue Flint Ethanol and Great River Energy's Coal Creek Station. The two entities are collaborating on a carbon capture storage project.

As a Richardton ethanol facility gears up to store its carbon emissions underground, the company that runs a coal-fired power plant north of Washburn has secured funding to help determine whether it should pursue similar technology.

Red Trail Energy, which turns corn into ethanol fuel at its Stark County plant, plans to drill a test well on its property within the next few months to further examine the rock where it’s seeking to store its carbon dioxide by compressing the gas and shooting it into the earth.

“Once we analyze the information we receive, that will tell us if we move forward with the injection process,” CEO Gerald Bachmeier said.

In McLean County, Great River Energy is mulling a carbon capture and storage project, as well, in partnership with neighboring Blue Flint Ethanol. The North Dakota Industrial Commission last month approved a $4.2 million matching grant to help fund a preliminary study examining the feasibility at Coal Creek Station.

“We’re seeing interest from our members for new energy that is a lower-carbon form,” said John Bauer, director of North Dakota generation for GRE, which is made up of 28 member cooperatives in Minnesota. “This is one way we could provide it.”

Carbon dioxide is a greenhouse gas that contributes to climate change. It’s created during the fermentation process at ethanol plants, and it makes up part of the flue gas that’s released from smokestacks at coal plants.

Ethanol project moving forward

The Red Trail Energy project, in the works since 2016, secured a key approval last week from the Industrial Commission, a three-member panel chaired by the governor that regulates the energy industry.

The company could soon drill the first injection well permitted by the state since North Dakota assumed oversight of such facilities from the U.S. Environmental Protection Agency last year.

The ethanol plant produces a nearly pure stream of carbon dioxide that requires minimal processing before it’s sent underground.

“Our capture, storage, pressure and injection costs are much lower than if you were looking to do it on a coal-fired facility,” Bachmeier said.

The flue gas at a coal plant is only partly carbon dioxide, and it needs to be separated from the rest of the gas in a more intensive process before injection.

Work is already underway to build a drilling pad on Red Trail property about a mile east of the ethanol plant, Bachmeier said.

The company plans to drill a test well by early spring to remove samples of rock in the Broom Creek and Inyan Kara formations, which lie at depths of 6,400 feet and 4,800 feet, respectively. Researchers also will examine the thick layer of impermeable “seal” rock surrounding those formations, said Kerryanne Leroux, principal engineer with the Energy & Environmental Research Center at the University of North Dakota.

That work, coupled with additional testing to determine the pressure, temperature and other information about those formations, will help identify the best site to target for carbon dioxide storage. It builds upon previous research of the area and a seismic study completed this past spring.

The testing prior to carbon dioxide injection is meant to give researchers “some scientific data and proof that it will stay and be permanent and won’t go anywhere,” Leroux said.

The carbon capture system also would include a monitoring well to gauge where the carbon dioxide migrates underground.

Through reducing its facility's carbon emissions, Red Trail Energy hopes to make its ethanol more attractive for markets in California, a state that has established a low-carbon fuel standard program, Bachmeier said. The program aims to reduce the carbon intensity of transportation fuels.

A federal tax credit for carbon storage also is driving the effort, he said.

The project is expected to cost $30 million, and the Industrial Commission in 2016 authorized a $500,000 grant to help pay for initial research. Red Trail Energy could begin injecting carbon dioxide by fall 2021, assuming the ongoing testing confirms the carbon capture and storage system is feasible.

Coal Creek considers carbon capture

Meanwhile, several other carbon capture projects are underway in North Dakota.

GRE is just beginning an $8.5 million study examining the feasibility of such a system for Coal Creek.

Bauer said “it’s great” that the state is helping the coal industry pursue such projects with money from coal taxes and other revenue.

“It allows funds to further research and to study processes like this to improve the industry,” he said.

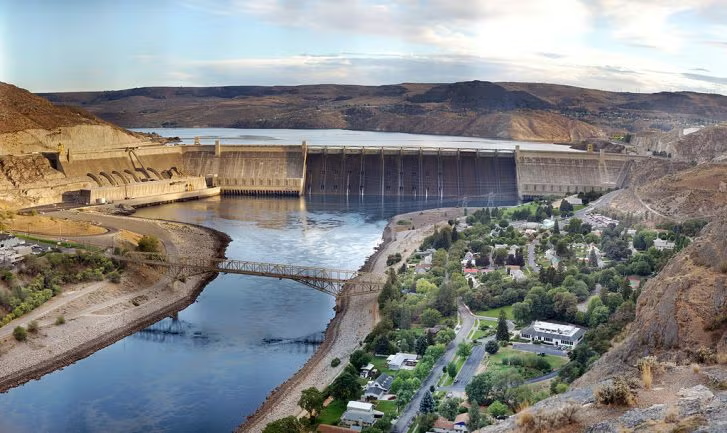

Coal Creek, with two units built in 1979 and 1981, is the largest power plant in North Dakota. Its electricity generally travels east over a transmission line to Minnesota.

GRE is looking to use an amine-based solvent, which is a liquid that absorbs carbon dioxide from flue gas. By separating out the carbon dioxide and injecting it underground, the company hopes to reduce Coal Creek's carbon emissions by at least 80%. It’s the same idea as with Project Tundra, an effort further along at Minnkota Power Cooperative’s Milton R. Young Station to capture and store carbon emissions.

“They’ve been very open, very willing to share,” Bauer said.

But GRE can’t just duplicate Project Tundra.

“The plants are different, the firing characteristics are different, the flue gas, the coal is different,” Bauer said.

Jason Bohrer, president and CEO of the Lignite Energy Council, said the research completed under Project Tundra is important for the rest of the state’s coal facilities. It’s shown that an amine-based carbon capture process is compatible with North Dakota’s lignite coal.

“All the power plants are very different, but I think what we learned is it is technologically possible to make the technology work in North Dakota,” he said.

The project at Coal Creek also involves Blue Flint Ethanol, which is eyeing the Deadwood rock formation 8,400 feet below the earth’s surface to inject carbon dioxide from its facility.

Blue Flint Ethanol produces 200,000 tons of the gas annually, far less than the 9 million tons at Coal Creek. The ethanol plant could inject the gas underground first given that its purer stream of carbon dioxide won’t require as much processing, Bauer said.

Construction must start by the beginning of 2024 for the project to qualify for a federal tax credit. If the preliminary study -- which is expected to be complete in a year -- shows that the project is worth pursuing further, GRE would then look for investors and sign contracts with technology providers, Bauer said.

Leroux with the EERC said she anticipates that if carbon capture and storage systems start operating in North Dakota, interest in the technology will grow. Whether a project is feasible will have a lot to do with a facility's proximity to the right storage conditions to make the economics work, she said.

“I would love to see more down the road,” she said.