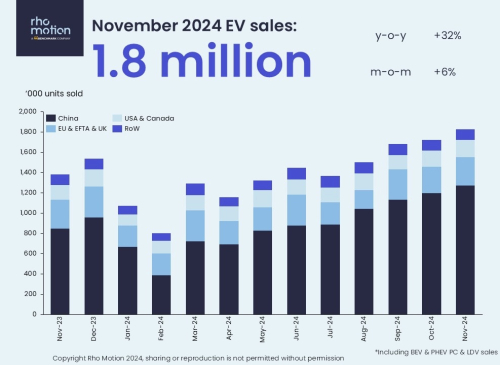

Snapshot electric vehicle sales in January - November 2024 vs Jan-Nov 2023:

Global: 15.2 million, +25%

China: 9.7 million, +40%

EU & EFTA & UK: 2.7 million, -3%

USA & Canada: 1.6 million, +10%

Rest of World: 1.1 million, +25%

The regional picture is somewhat uneven with Europe shrinking 3% this year so far and once more China accounts for over two thirds of the electric vehicles sold in November.

—Rho Motion Data Manager, Charles Lester

The EU & EFTA & UK EV market remains down year-on-year by -3%, after selling 280,000 units in November 2024, reaching 2.7 million units sold YTD. The UK market has had a strong second half of 2024, growing by 17% year-to-date, bolstered by the ZEV mandate. Other major European market, such as Germany, France, and Italy, remain down on a year-to-date basis. There has been increased intensity over the past month, most recently from the European People’s Party Group (EPP) after they released a position paper calling for a revision of the EU emission targets—including changing the 2035 ban on internal combustion engines (ICE) and an assessment of the fines expected from the 2025 emission targets.

China continues to reach new heights with 1.3 million units sold in November 2024, with record monthly BEV sales and flat PHEV sales on a month-on-month basis. The growth in EV sales in month-on-month in November 2024 has almost entirely come from BEV sales, with over 70,000 units more. Most of this growth resulted from monthly increases in sales from Geely, Tesla, and Changan.

However, on a year-to-date basis, PHEV sales have almost doubled, whereas BEV sales in China have grown by 18% year-to-date.

The US & Canada market continues to grow at a steady pace of 10% YTD. Rho Motion expects continued strong growth towards the end of the year, driven by President Elect Donald Trump’s reported aim to get rid of the Biden tax credit. Rho Motion expects this would bring forward purchases from consumers in order to take advantage of the tax credit.