Solar PV additions in the European Union are forecast to reach 65.5GW in 2024, according to trade association SolarPower Europe’s (SPE) latest report.

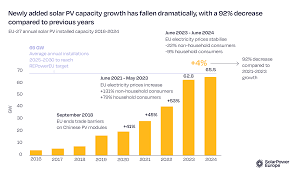

After years of rapid growth with double-digit increases from previous years, Europe is facing a 92% slowdown in solar growth compared with the growth between 2021 and 2023. Last year was marked by a record 62.8GW of solar capacity additions, while this year’s growth from 2023 only amounts to 4.4% – the lowest market growth since 2017.

The slowdown was not surprising for SolarPower Europe. “Following the solar boom during the gas crisis, the urgency of going solar has waned for citizens as their bills normalise,” the EU Market Outlook for Solar Power report said. “Developers face challenges for different reasons. The energy system has not kept up with the solar growth curve, and building bankable utility-scale solar becomes more difficult as grid and flexibility bottlenecks tighten.”

SPE’s data showed the residential rooftop market has seen a nearly 5GW decrease from 2023 with 12.8GW of capacity additions in 2024.

This decrease is partially down to the removal of incentives for rooftop solar (for instance, the Netherlands will remove its net metering scheme for residential solar by 2027) which saw decreases in residential solar in Germany, Austria, Italy, Poland, the Netherlands, Belgium, Sweden, Spain, and Hungary.

The slower growth of solar PV in 2024, along with residential solar stumbling, has affected the biggest European markets too.

Half of the top 10 biggest solar markets in 2024 have seen a drop in capacity additions from the previous year. Spain, Poland, the Netherlands, Austria and Hungary have seen their solar PV market contract since the end of the energy price crisis and policymakers failing to offer regulatory stability to maintain investment appetite in solar.

The Netherlands has seen the steepest drop, with an annual decrease of 1.8GW from 2023, whereas the growth in the other five markets has been “modest”, according to the report. France saw the biggest increase, with 1.5GW added in 2024.

Germany (with 16.1GW added in 2024) continues to be the largest market in the European Union for solar PV, followed by Spain (9.3GW) and Italy (6.4GW).

Walburga Hemetsberger, CEO at SolarPower Europe, said, “European policymakers and system operators can consider this year’s report a yellow card. Slowing solar deployment means slowing the continent’s goals on energy security, competitiveness and climate. Europe needs to be installing around 70 GW annually to hit its 2030 targets – we need to consider corrective action now, before it’s too late.”

Challenges ahead for solar PV

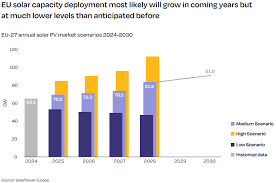

Looking ahead, the report forecasts continued single-digit growth between 3-7% from 2025-2028. SPE said this would still allow the EU to reach its 2030 solar PV target of 750GW as it projects 816GW of installed solar PV by the end of the decade. However, the trade association warns that Europe could still miss the mark by 100GW if it follows the wrong path.

The trade association forecasts 91.9GW of solar PV additions across the 27 EU member states in 2030. Chart: SolarPower Europe.

In the report, SPE outlined several challenges looming for the solar industry in the coming years. As mentioned earlier, the residential market is poised to continue its downward path. However, the report highlights an increased interest in balcony solar deployments. In Germany alone over 220,000 systems – around 800W – were added in the first half of 2024.

Inflexible European grids and limitations in cross-border supply of capacity are major hurdles for the utility-scale sector. SPE already brought up inflexible grids in a report earlier this year, and said it is “becoming increasingly problematic”. Increased curtailment and grid congestion are also ever-increasing problems in the region.

Moreover, the slow electrification rate of the EU – which has been stuck at 22-23% in the past five years, according to SPE – is at the heart of the slowdown. Accelerating this shift in key sectors such as industry, heating and transportation could help spur the growth of renewables.

Permitting and land access continue to be a challenge in many markets, which end up delaying the development of solar projects. SPE said simplifying these processes and ensuring land availability are critical to maintaining utility-scale solar deployments

Finally, the report said the political shift towards right-wing parties across the continent, often with less support for renewables, poses a challenge. Earlier this year, the Italian government moved to ban solar deployments on agricultural land, an attention-grabbing move which sought to end the “wild installation” of ground-mounted PV but which experts said was “illogical”.

Policy recommendations

SPE calls policymakers to make 2025 a year of policy action on energy system flexibility and electrification.

Furthermore, the trade association recently called for the implementation of an action plan to support the inverter manufacturing industry. In its annual market report, it mentions that both the inverter and solar manufacturers in Europe “continue to be under pressure”. It is increasingly unlikely that Europe will achieve its initial target to onshore 30GW of domestic solar manufacturing capacity by 2025, as imagined in 2022 when the European Commission launched the European Solar PV Industry Alliance.