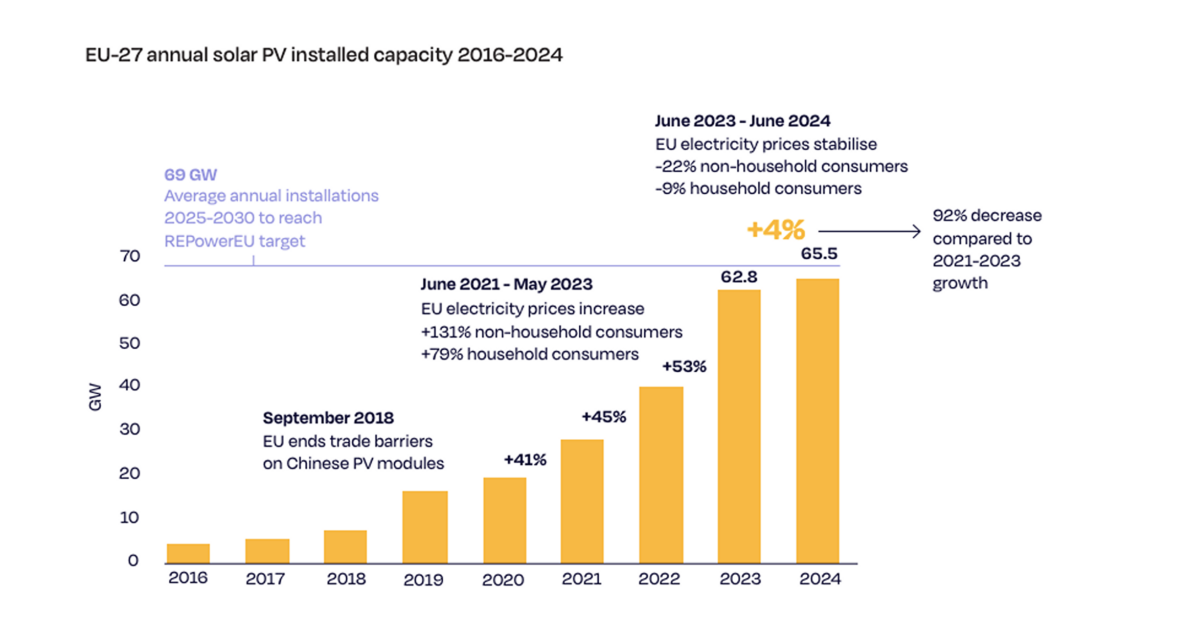

Developers deployed 65.5 GW of solar across the European Union in 2024, according to SolarPower Europe’s “EU Market Outlook for Solar Power 2024-2028.”

The figure reflects 4% annual growth compared to 2023’s 62.8 GW of installations, a sharp drop from the 53% growth recorded between 2022 and 2023. The EU solar fleet now totals 338 GW, a fourfold increase from 82 GW a decade ago.

SolarPower Europe attributed the slowdown to factors beyond declining solar component prices and lower upfront costs for installations. Ground-mounted utility-scale solar projects saw an average cost reduction of 28% in 2024.

Despite reduced costs of capital, EU solar investment dropped for the first time this decade, falling from €63 billion ($66.2 billion) in 2023 to €55 billion in 2024.

Walburga Hemetsberger, CEO of SolarPower Europe, called the report a warning for European policymakers and system operators.

“Slowing solar deployment means slowing the continent’s goals on energy security, competitiveness, and climate,” Hemetsberger said. “Europe needs to install around 70 GW annually to meet its 2030 targets. Corrective action is needed now, before it’s too late.”

SolarPower Europe’s forecast for 2025 to 2028 suggests growth will stabilize between 3% and 7% in the coming years.

The market is expected to add 70 GW in 2025, reflecting a 7% growth rate fueled by utility-scale projects initiated during the past two years, which benefited from record-low module prices. Growth rates are projected to drop to 3% in 2026, with 72.3 GW of new solar capacity, as developers respond to grid constraints and market uncertainties.

SolarPower Europe’s medium scenario forecasts a 6% improvement to 76.5 GW in 2027 and a 7% increase to 81.5 GW in 2028.

“This slower growth reflects severe structural challenges, in particular in those Member States where adaptations of policy frameworks and infrastructure have been lagging behind the solar sector’s rapid evolution into a notable pillar of power supply,” the report said. “It also remains to be seen what the changing political landscape to the right means for solar in the EU.”

Sluggish electrification rates continue to suppress demand in the solar market, with the continent’s electrification rate stuck at 23% over the past five years, leaving much of the energy system reliant on fossil fuels. SolarPower Europe noted that the Electrification Alliance is pushing for a 35% electrification rate by 2030.

The report also highlights a lack of energy system flexibility, which has led to solar curtailment and negative pricing, undermining European energy security and competitiveness as additional factors contributing to the slowdown.

Residential solar installations fell sharply in 2024, with 5 GW of new home solar added compared to 12.8 GW last year. SolarPower Europe attributed this decline to the fading impact of the energy crisis and forecasts this trend will persist in the coming years.

Larger solar installations are likely to grow faster than rooftop projects in the EU during the latter half of the decade, according to the report. However, rooftop installations, starting from a larger base, are expected to retain a greater share of the EU’s total solar capacity through the decade compared to utility-scale projects.

At the national level, SolarPower Europe found five of the top ten EU solar markets –Spain, Poland, the Netherlands, Austria, and Hungary – installed less solar in 2024 than in 2023. Meanwhile, Germany, Italy, France, Greece, and Poland saw modest gains, with most adding about 1 GW more than last year.

Between 2025 and 2028, Germany, Spain, and Italy are projected to lead the EU’s solar market growth.