OPEC and its non-OPEC allies decided to reduce their collective output target by a further 500,000 barrels a day for the first quarter of 2020, taking the reduction from 2018 baselines to 1.7 million barrels a day. Saudi Arabia said it would reduce its own target by an additional 400,000 barrels a day — as long as all the other participants adhered to their pledges.

The International Energy Agency, the U.S. Energy Information Administration and the Organization of Petroleum Exporting Countries all show global oil inventories rising in the first half of next year if OPEC producers keep pumping as they were in November, underlining the need for the group to deliver the output cuts in full, including Saudi Arabia’s voluntary curbs.

Without the cuts, the size of the first-half stockbuild ranges from an average 550,000 barrels a day seen by OPEC up to 1.24 million barrels a day forecast by the IEA, with the EIA closer to the producer group’s estimate. The build almost disappears from the forecasts published by OPEC and the EIA if the cuts from the OPEC+ alliance are delivered in full. The IEA still sees a build of about 800,000 barrels a day.

While OPEC left its oil demand forecasts for both 2019 and 2020 unchanged for a second month, there were further cuts to the consumption numbers foreseen by the IEA and the EIA for both years.

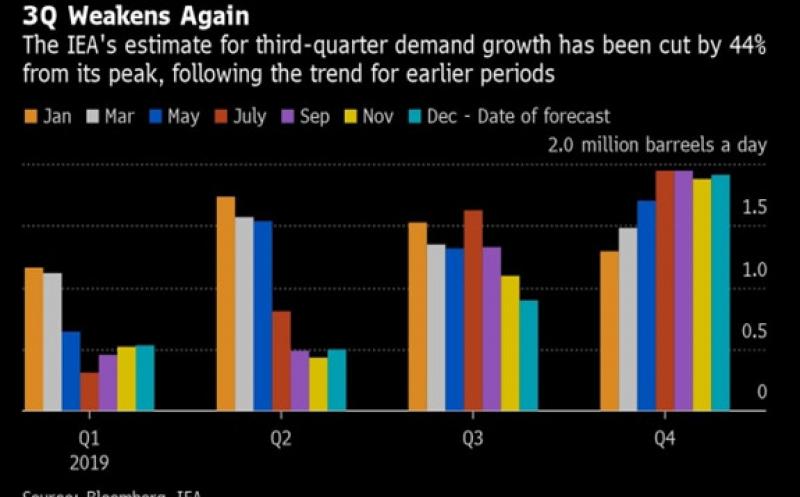

The biggest curbs were made to estimates of oil demand in the third quarter of this year, as more real data became available. The IEA reduced its estimate by 210,000 barrels a day compared with what it said a month ago, while the EIA made an even bigger cut of 290,000 barrels.

Those reductions led to further downward revisions to estimates of demand growth from both agencies. The IEA now pegs third quarter global oil demand growth at just 900,000 barrels a day. That’s down from a forecast of 1.62 million barrels a day in made in July. The EIA cut its third-quarter growth to just 750,000 barrels a day, down from 1.42 million barrels in July and as much as 1.81 million at the start of the year.

Assessments for the July-to-September period are following the pattern set by the first two quarters, with demand estimates being slashed as real data begin to emerge and optimistic forecasts prove unsustainable. The IEA now sees third-quarter demand growth below 1 million barrels a day for the first time. The EIA has been in that position since September, while OPEC still has growth at 1.24 million barrels.

The IEA’s forecasts for the current quarter are still strong, with some provisional data beginning to emerge for October. The agency sees a reversal of fortunes for the OECD group of developed nations, with oil demand expected to grow year on year by 590,000 barrels a day in the fourth quarter after contracting by 190,000 barrels in the previous three-month period. It also sees growth accelerating among the non-OECD countries, reaching 1.31 million barrels a day from 1.09 million in the third quarter.

The EIA has begun to cut its forecast for fourth-quarter global demand growth, which now stands at 1.26 million barrels a day, down from 1.66 million barrels in July, but the IEA has yet to follow suit. It still sees demand growth of 1.91 million barrels a day in the last quarter of this year, that’s up a little from its view last month and only slightly down on the forecast of 1.95 million barrels that it made in July.

For OPEC to reach its new output targets next month is going to be a big ask. Using OPEC secondary sources data, they will need to reduce their collective output by 288,000 barrels a day. That may not sound like a lot — and for some countries it isn’t — but it is where the burden of action lies that could cause problems for the group.

Within that total, Angola is allowed to raise its production by almost 200,000 barrels a day — an impossible feat for the country which has seen output slump due to a lack of new projects to offset steep decline rates at deep-water fields. At best, it may be able to restore about half that amount, taking production back to where it was in September-October.

Whether Iraq will be able make the 177,000 barrels a day of additional cuts from its current production, which it would need to do in order to comply with its new target, is also far from certain. And that will raise questions over Saudi Arabia’s willingness to continue producing at well below its target rate.

If the deal breaks down, all three agencies agree that stockpiles will be back on an strong upward trend in the coming months. Even if it holds, none of the three is projecting a significant draw in inventories until the second half of 2020.