Hydrogen production is gaining momentum as a key component to the energy transition and central to it is electrolyser technology. There is increasing interest from European project developers in China’s potential to lower initial investment costs through inexpensive yet quality electrolysers. China’s low-cost pressurised alkaline electrolysers have the potential to cut total investment cost in half, seriously threatening European manufacturers, but cheap Chinese electrolysers also face risks of potential trade barriers in the EU.

In our latest report, we look at what’s giving China its competitive edge in the production and export of electrolyser technology.

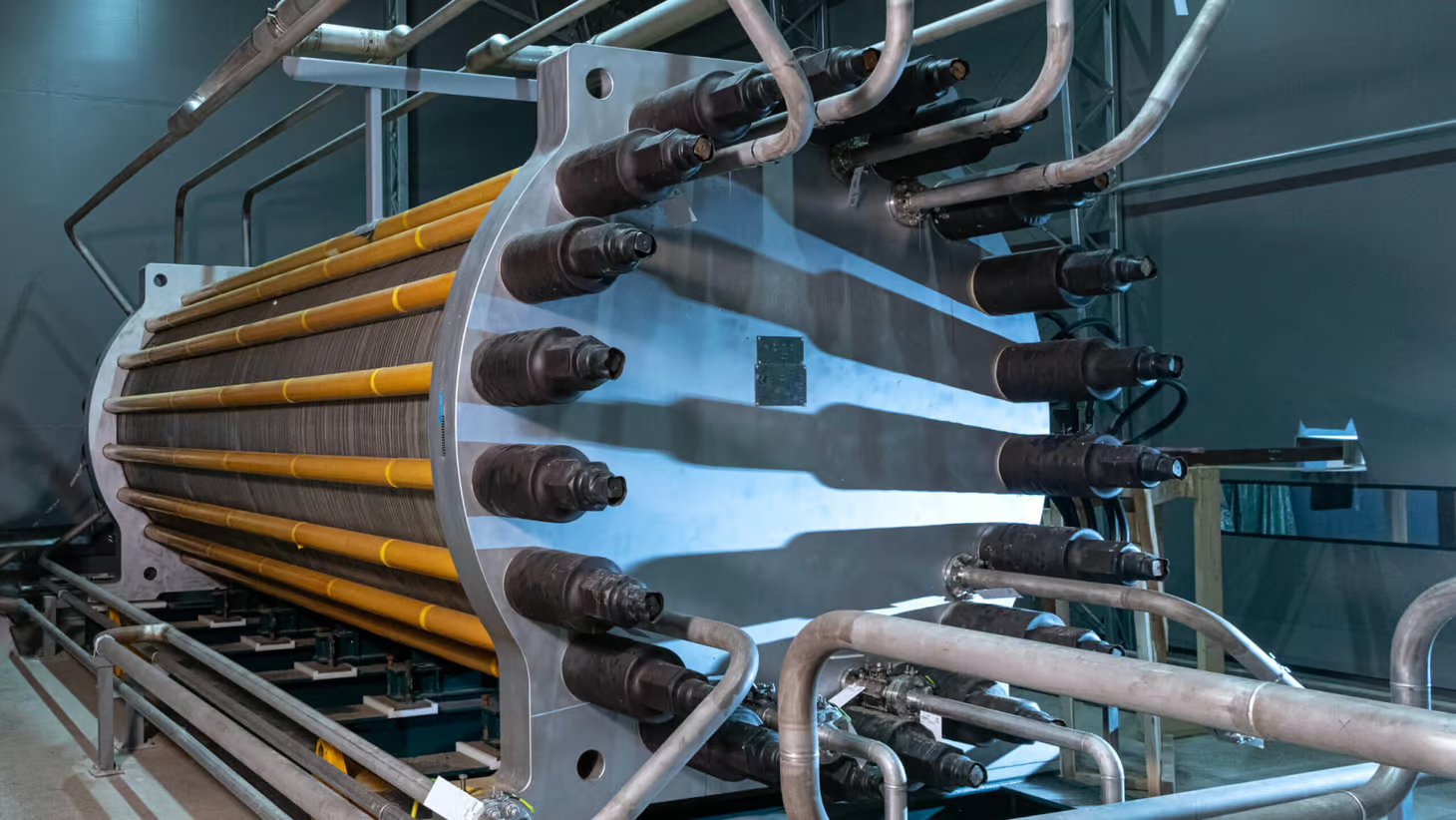

China has established itself as a key player in the global electrolyser market leveraging its mature manufacturing capabilities of alkaline (ALK) water electrolysis technology. With manufacturing automation further ahead than anywhere else in the world, China’s GW-scale ALK capacities stem from around 40 years of experience in the chloralkali electrolyser industry. It’s this experience and longevity that has allowed China to build a vertically integrated supply chain, resulting in cost savings few other countries can match.

Chinese solar and wind equipment manufacturers are looking to expand their business into electrolysers as a way of diversifying their product offerings. These new entrants are reshaping the existing electrolyser market, with fast capacity deployment, fully automated production processes and lessons learned from the renewables sector.

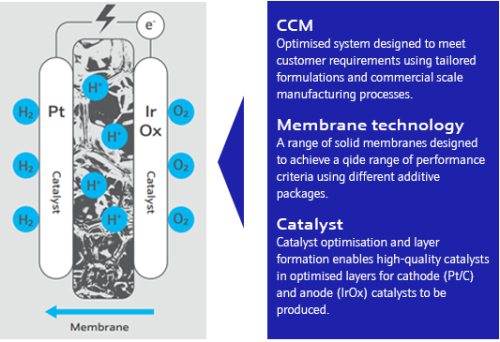

At present, it’s a different story for China’s proton exchange membrane (PEM) technology which lags Western PEM in membrane technology and remains in the initial stages of MW-scale manufacturing. However, with its production capacity and strategic cost advantages, China holds a strong position for future growth.

A dominant production capacity

China currently houses roughly 60% of the world’s electrolyser manufacturing capacity and is expected to retain this position by erecting most of the new-build capacity over the next few years. High manufacturing production capacity means Chinese electrolyser equipment can significantly cut project costs, which has intrigued European project developers and concerned European OEMs.

Chinese pressurised alkaline (ALK(P)) technology is projected to deliver around 45% total investment cost savings for projects in Germany by 2030. It has a competitive edge due to its extensive manufacturing base and numerous operational projects, which provide valuable feedback for Original Equipment Manufacturers (OEMs). Most global projects taking FID in the next few years will target ALK(P) technologies near-term, giving China the global advantage for supply through to 2030.

China currently operates more than 600 MW of renewable-powered electrolysers, with this capacity expected to increase to approximately 2.5 GW by 2024. As the country with almost 50% of operational electrolytic project capacity to date, China’s owners, operators, and OEMs are gaining significant amounts of valuable data and operational experience. This knowledge is crucial to refining and optimising operating performance. It has been shown that the performance of Chinese ALK(P) electrolysers is steadily improving, driven largely by an increasing number of Chinese OEMs increasing their focus on safety and rigorous testing procedures. These manufacturers are focusing more on quality control to ensure that their electrolysers are optimised for performance and reliability.

Understanding export prices and additional costs

Chinese OEMs are actively seeking overseas opportunities for electrolyser export, especially for regions such as Europe that have large-scale hydrogen projects under development and decarbonisation mandates to support them. The price of exported, Chinese ALK(P) electrolysers are roughly 25% the cost of ALK(P) electrolyser prices in Germany while Chinese PEM electrolyser export prices are not much different from Western counterparts.

When we look at additional costs for export, the export premium1 for Chinese ALK and PEM electrolysers ranges from 25%-40% of the total cost, driven primarily due to the need for higher quality materials, which account for 15%-30%; and certification fees, which amount to between 5%-10%. The requirement for higher quality materials, which is the most significant factor in the added cost, is largely determined by developer specifications, particularly regarding subcomponents, control systems, and processing quality assessments. Currently, the delivery time for Chinese electrolyser export ranges from 6 to 11 months but can be affected by a number of factors including distance, order scale and certification requirements.

Note 1: The export price of Chinese electrolysers is assumed to be CIF price, which means the buyer (overseas EPC/developer/etc.) is responsible for the import process and the costs associated with bringing the shipment through customs and delivering the products to their final destination. No additional/special/anti-dumping import tariffs have been imposed on Chinese electrolysers yet. The ordinary import tariff rates for electrolysers depend on trade agreements between the country of origin and the country of destination.

Exploring the routes to export

Overseas EPCs and developers are expected to procure Chinese electrolysers directly in the near term. Over 200MW overseas orders have been secured by Chinese electrolyser OEMs year-to-date. However, potential local content requirements and trade tariffs could shift the dynamic, where overseas facility investment by Chinese OEMs abranded as a Western electrolyser system with a Chinese ALK(P) stack could become a trend. If this is the case, the cost advantage of Chinese electrolysers will likely decrease.

Yet Chinese ALK(P) electrolysers are set to start operations abroad with small-scale pilot orders to establish credibility for performance. To support overseas projects, Chinese OEMs are acquiring CE and ASME certifications to demonstrate eligibility and, as they collect product performance data, capacity expansion will follow a multi-tier model. As Chinese OEMs expand market share, export prices are expected to fall by 30%-35% by 2030.