Solar photovoltaic and wind energy production

In the week of December 23, solar photovoltaic production increased compared to the previous week in the main European electricity markets, continuing the upward trend of the previous week. The German market recorded the largest increase with 63%, followed by the Portuguese market with an increase of 23%. In the Spanish, Italian and French markets, solar photovoltaic production increased by 13%, 14% and 19%, respectively. In the case of Spain, the upward trend continued for the sixth consecutive week.

On December 29, the Italian market reached an all-time record for photovoltaic production for a single day in December, with 53 GWh generated, surpassing the previous record of December 21, when 47 GWh were generated with this technology.

In the week of December 30, according to AleaSoft Energy Forecasting’s solar production forecasts, solar production will increase in Germany and Italy and decrease in Spain.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

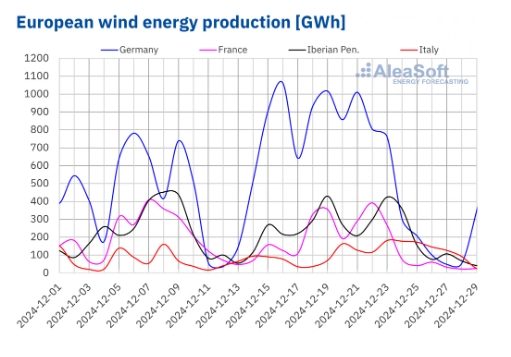

In the week of December 23, wind power production fell in most major European markets compared to the previous week. The French and German markets recorded the largest drop, 71% in both cases. The Spanish and Portuguese markets experienced declines of 36% and 39%, respectively. The exception to this downward trend was the Italian market, where wind production increased for the second consecutive week, this time by 47%.

On Monday, December 23, the Italian market reached an all-time record for wind production, with a total generation of 182 GWh.

In the week of December 30, according to AleaSoft Energy Forecasting’s wind power production forecasts, the downward trend will reverse in Germany and France, while in Italy, Portugal and Spain wind power production will decrease.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

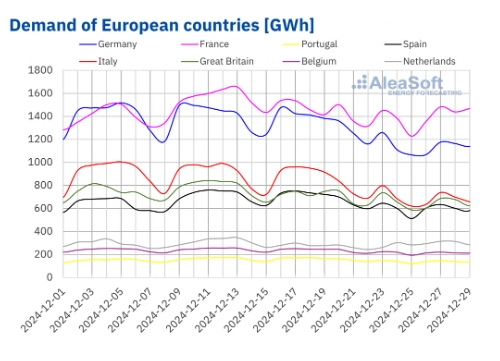

In the week of December 23, electricity demand decreased compared to the previous week in most major European electricity markets for the second consecutive week. The falls in demand are associated with the decrease in work activity due to the Christmas holidays. The Italian market recorded the largest drop, 20% in this case, for the third consecutive week. The German and Iberian markets also experienced double-digit declines, 16% in Germany and 14% in both Spain and Portugal. In the other main European markets, demand fell by 3.1% in France and 9.8% in Belgium. The exception was the Dutch market, where demand increased by 7.1%, reversing the downward trend of the previous week.

During the last week of 2024, average temperatures decreased compared to the previous week in all analyzed markets. The decreases ranged from 0.3 °C in Italy to 5.2 °C in Germany.

For the week of December 30, according to AleaSoft Energy Forecasting demand forecasts, demand will increase compared to the previous week in the German, French, Italian, Spanish, Belgian, Dutch and British markets, while in Portugal it will continue to decrease.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

In the week of December 23, prices increased in most major European electricity markets, driven by declining wind generation in much of Europe and higher gas and CO2 prices.

Germany’s EPEX SPOT market recorded the largest price increase, with the weekly average price up by 99% compared to the previous week. The EPEX SPOT markets in the Netherlands, France and Belgium, and the UK N2EX market saw increases of 74%, 72%, 69% and 63%, respectively.

Markets located in southern Europe had the smallest increases. Italy’s IPEX market recorded the smallest increase with 0.9%, while Portugal and Spain’s MIBEL market showed increases of 8.4% and 9.0%, respectively.

The exception to the price increases was the Nord Pool market of the Nordic countries, which recorded a 16% decline compared to the previous week.

During the fourth week of December, the average price in most of the main European electricity markets exceeded €100/MWh. The Italian market reached a weekly average of €121.55/MWh, followed by the UK, with an average price of €110.99/MWh, and the Spanish and Portuguese markets, with a price of €108.31/MWh. The Nordic market recorded the lowest weekly average price with €19.71/MWh.

Between Friday, December 27, and Sunday, December 29, European markets recorded the highest daily prices of the week. On the 27th, the UK market reached a price of €129.32/MWh. The EPEX SPOT markets recorded their highest daily prices on Saturday 28, at around €121/MWh. Finally, on Sunday 29, the Italian market reached a daily average of €143.60/MWh, followed by the Iberian market, with €136.15/MWh.

For the first week of 2025, AleaSoft Energy Forecasting price forecasts indicate a decrease in prices in the EPEX SPOT and N2EX markets due to a recovery of wind power production. However, in the Iberian and Italian markets, prices are expected to continue increasing because of lower wind power production.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

In the week of December 23, Brent oil futures for Front-Month on the ICE market trended higher, closing on Friday, December 27, at $74.17/bbl, a value 1.7% higher than the last closing price of the previous week.

The reduction in US oil reserves, which was greater than expected, favored the increase in prices during the fourth week of December. For 2025, the market is expected to be influenced by geopolitical tensions and the US-China trade war. The arrival of President Donald Trump adds uncertainty as to whether sanctions against Iran will be tightened. On the other hand, the International Energy Agency projects a surplus in the oil market by 2025, driven by production expansion in countries such as the United States and Brazil, while China’s transition to electric mobility is slowing its demand for crude oil.

Meanwhile, TTF gas futures on the ICE market for Front-Month continued the upward trend of the previous week and closed on Friday, December 27 at €47.73/MWh, 8.2% higher than the last price of the previous week.

The possible suspension of natural gas flow from Russia to Europe through Ukraine, with the end of the agreement between the two countries on January 1, and the decrease in gas reserves in the European Union, which, with the arrival of winter, are already below 74% according to data from GIE, Gas Infrastructure Europe, continued to put upward pressure on gas prices.

The CO2 emission allowance futures on the EEX market for the December 2025 benchmark contract continued to rise during the fourth week of December, following the turnaround in the middle of the previous week. On Friday, December 27, they closed at €71.57/t, 4.9% above the last price of the previous week, following the same behavior of gas prices.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting Analysis for Batteries and Hybridization

AleaSoft Energy Forecasting’s AleaStorage division provides forecasts and reports for energy storage projects, including stand-alone projects and hybrid systems such as wind power and batteries, solar photovoltaic and batteries, combinations of wind, solar photovoltaic and batteries, as well as other hybrid systems that integrate hydro, CHP or consumption. AleaStorage’s services cover revenue calculation, optimization, management and sizing of energy storage systems, all adapted to the specific needs of each project. These services are essential for assessing project profitability, securing financing and structuring PPA with energy profiles closer to a baseload profile.