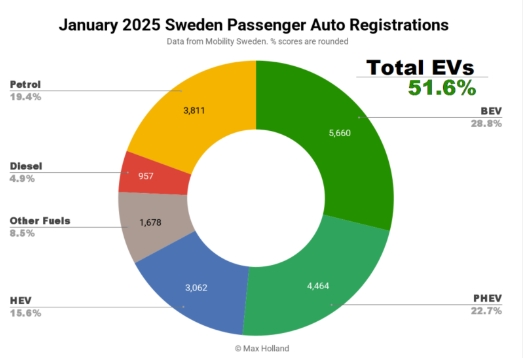

January’s sales totals showed combined plugin EVs at 51.6% share in Sweden, with full electrics (BEVs) at 28.8% and plugin hybrids (PHEVs) at 22.7%. These figures compare YoY against 52.5% combined, 28.6% BEV and 23.8% PHEV.

There was a small anomaly in the January market, with an unusual surge for “other fuels” – at 1,678 units – over 5x their recent monthly average. These are almost all vehicles classified at “other” only because they are “able to” run on ethanol (even though they may in practice be mostly run on regular gasoline / petrol / benzine). Their January surge was a “last chance” pull-forward ahead of a Swedish regulation change from February 1st which – due to the reality of their mostly being run on gasoline – now puts a heavier tax burden on them. The new rules now tax them in-line with gasoline-only vehicles, closing a former loophole. Expect a severe hangover for this category in February and March, and general weakness going forward.

Plugless hybrids (HEV and MHEVs) grew volume by 67% YoY, their highest monthly number since 2020. These are mainly a quick-and-easy stopgap for legacy auto makers towards meeting tightening emissions rules (relative to ICE-only cars). Since these are effectively substituting sales of ICE-only cars, the latter declined in volume to near-record lows. Even so, together, the combined sum of HEV and ICE-only cars grew volume by 4.5%, underperforming the overall market’s 14% growth. Thus their combined share fell YoY from 43.7% to 39.9%.

For plugins, despite their fractional fall in market share, sales volume actually grew decently YoY, from 9,006 units to 10,124 units. The slight drop in plugin share comes simply from not increasing their volume as much as the competing ethanol powertrain vehicles, in their anomalous pull-forward, discussed above.