A general view of a new crude distillation unit under construction at Exxon Mobil's refinery in Beaumont, Texas, U.S., November 23, 2022.

The U.S. primarily produces light shale crude, while over 70% of its refining capacity is designed for heavier grades from Canada and Mexico. Adapting refineries to handle more light crude requires significant time and expense. One unnamed source noted that companies might consider gradually increasing light crude capacity, but this would still take years and cost hundreds of millions.

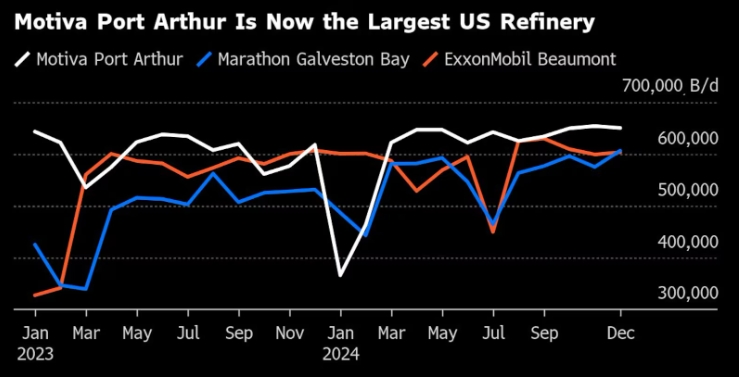

Chevron’s Vice President of Crude Supply and Trading, Barbara Harrison, stated: “Nobody is making these investment decisions based on very short-term market fluctuations.” She explained that Chevron, the sixth-largest U.S. refiner, is content with its current setup, emphasizing that long-term market trends guide such costly projects. Refinery upgrades, like Exxon Mobil’s $2 billion expansion in Beaumont, Texas, completed in 2023, or Chevron’s $475 million retrofit in Pasadena, Texas, finished in 2024, highlight the scale of these efforts.

Meanwhile, factors like growing electric vehicle use and competition from foreign refineries are reducing gasoline demand. Phillips 66, the fourth-largest U.S. refiner, predicts a modest global demand increase of 0.8% in 2025, with only 0.2% in the U.S., and plans to close its Los Angeles-area refinery later that year. LyondellBasell also began shutting its Houston refinery in 2025. The Energy Information Administration forecasts U.S. net crude imports dropping 20% to 1.9 million barrels per day in 2025, the lowest since 1971, due to higher domestic output and lower refining needs.

Despite Trump’s ambitions, U.S. oil production is expected to level off by the decade’s end. John Auers of Refined Fuels Analytics predicts light shale oil output will peak in the early 2030s, while global heavy crude production grows into the 2040s, discouraging refiners from retooling. Adjusting a medium-sized refinery for light crude could take years and cost millions, a commitment many see as risky amid uncertain trade policies and shifting markets. Instead, refiners may seek heavy crude from alternative sources like Colombia if imports from Canada and Mexico decline.