Managing Director John Borshoff explained that while Tumas is viable at current long-term uranium prices, these levels fall short of supporting the production scale needed to meet future demand. He stated: “The Tumas Project is ready to take the next step but, as we have consistently stated, a healthy prevailing uranium market is a key prerequisite.” Borshoff added: “The final project approval will therefore be delayed until uranium prices fully reflect a sustainable incentivisation environment essential to encourage development of new projects for much needed additional production.”

Borshoff highlighted a robust demand outlook, fueled by decarbonization efforts, rising energy needs, ongoing supply constraints, and emerging requirements from data center developers. He expressed confidence in the staged strategy, noting: “The reality is there are limited greenfield uranium deposits available for start-up globally over the next 10 years to satisfy projected demand, and new uranium supply will be virtually impossible to achieve in the current price environment.” He further remarked: “Nuclear utilities cannot ignore the fact that unless uranium prices increase to appropriate levels and large amounts of capital become available to the supply sector, those greenfields projects will remain undeveloped.”

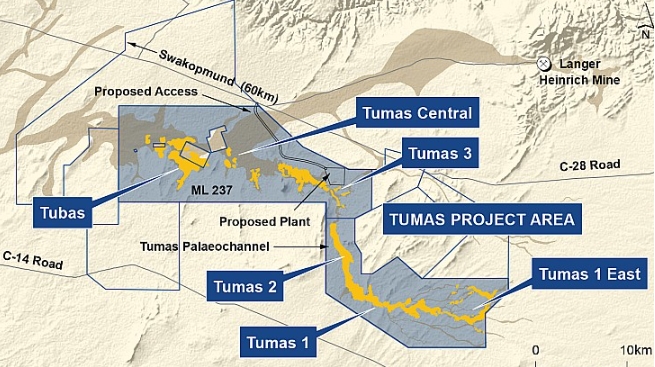

An updated Ore Reserve Estimate for Tumas shows 79.3 million pounds of U3O8 in proved and probable reserves, graded at 298 parts per million, calculated at a uranium price of USD100 per pound. According to the company’s revised definitive feasibility study completed in March, this supports a 30-year mine life with an annual output of 3.6 million pounds of U3O8. Deep Yellow remains optimistic about price improvements, viewing them as unavoidable given the global supply-demand dynamics, but will hold off on major construction until the market aligns with its expectations.