Texas is carving out a leadership position in adopting large-scale battery storage as battery prices fall, technology improves and electricity demand grows, potentially paving the way for renewable power to dominate the state’s energy mix.

Large-scale battery storage is making its way onto the Texas power grid, potentially paving the way for renewables to dominate the energy mix.

Large-scale battery storage is making its way onto the Texas power grid, potentially paving the way for renewables to dominate the energy mix. The amount of storage on the state’s power grid is still small — just 100 megawatts in a system with a generating capacity of nearly 80,000 megawatts — but is expected to more than triple to about 360 megawatts in 2020 and grow even faster in coming years. The state’s grid manager, meanwhile, is considering proposals to develop some 7,200 megawatts of large-scale battery storage within the next five years or so, exceeding the amount of natural gas generation in the pipeline.

“It’s a stunning development,” said Sam Huntington, an analyst specializing in battery storage for the global consulting firm IHS Markit, “and nothing anyone would have predicted a couple years ago.”

While only a fraction of proposed generation projects typically get built, Huntington said the flood of battery proposals indicates where the market is headed. Texas, meanwhile, has become one of the leaders in grid-scale storage, in part because it can design policies without waiting for the Federal Energy Regulatory Commission, where a contentious rule-making process for deploying batteries on the grid is underway. The Texas power grid, which is not interconnected with other state systems, does not fall under FERC’s jurisdiction.

In Texas, which ranks fourth among states in installed battery capacity, regulators are wrestling with broad, first-time issues such as how to treat energy resources that both draw and generate power and more mundane interconnection concerns of how to effectively and efficiently link batteries from wind farms, solar farms and stand-alone storage units to the grid. At the same time, the opportunity that energy storage provides is driving the value of renewables higher.

Wind energy, for example, generates vast amounts of power at night, when winds in West Texas are at their strongest, but electricity consumption — and prices — are at their lowest. Batteries would allow wind generators to store that power and sell it in the afternoon hours, when demand and prices are at their peak.

On HoustonChronicle.com: Solar expected to disrupt fossil-fuel apple cart

One energy specialist predicts that battery storage will pave the way to more investments in renewable energy, converting wind and solar from intermittent power sources into quickly dispatchable and reliable generators of electricity.

“It’s essentially the marriage we saw on the horizon for years,” said Michael Lumbley, chief operating officer of Alternative Resource Group, a renewable energy infrastructure developer in Austin.

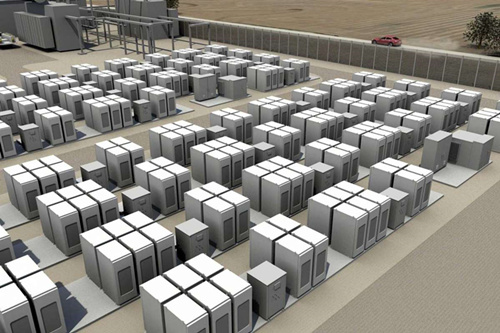

The power industry is still several years away from building enough large-scale storage for Texas to run on renewables, but companies are making strides toward that eventuality. Vistra Energy of Irving said in January began operating a 10 megawatt lithium-ion story system connected to the company’s solar farm in Upton County, about 50 miles south of Midland.

The battery system, which captures excess solar energy produced during the day and releases the power when it is most needed, is the largest in Texas and the seventh largest in the United States, according to Vistra. Another project, a collaboration between NRG Energy and Japanese conglomerate Toshiba created a 2 megawatt lithium-ion-based battery storage system two years ago near a wind farm in Howard County, about 50 miles northeast of Midland.

The growth of battery storage has been spurred by falling prices for batteries, turning what was once an expensive science experiment into an increasingly affordable power source. The price for lithium-ion batteries for electricity storage fell 35 percent to $187 per megawatt hour in March compared to the first half of 2018, according to the research firm Bloomberg New Energy Finance.

By 2024, Lumbley projected, the costs for installing battery storage will fall low-enough for the technology to become widespread. At that point, batteries would begin to undercut one of the key roles for natural gas-fired power plants: filling in for renewables when the winds aren’t blowing and the sun isn’t shining.

“By adding storage,” Lumbley said, “there’s just no more air left in the room for new natural gas projects.”

Vexing question

Texas never pushed renewables as a social policy, but the state become the nation’s top wind producer because wind energy made economic sense. Strong winds brought developers to the Texas Panhandle and West Texas, utilities built transmission lines to carry the loads and federal tax subsidies made wind farms competitive with traditional generation.

Solar energy has been slower to catch on in Texas, but is now growing quickly. Texas is expected to have about 3,000 megawatts of solar capacity by year end which should more than double to about 6,200 megawatts in 2020, according to ERCOT. By 2021, Texas is expected to have more than 11,000 megawatts of solar power capacity.

Batteries would only add to this growth, analysts said, by making low-cost renewable power available consistently.

Texas regulators are scrambling to keep up with the development of battery storage. The Electric Reliability Council of Texas, the state’s grid manager, launched a new battery storage task force in October to integrate battery energy storage into the grid.

One vexing question faced by Texas regulators is whether regulated utilities that provide wires that distribute electricity can invest in battery storage. The state law that deregulated electricity established competitive markets for retail sales and power generation, but left transmission and distribution as regulated monopolies. To prevent utilities from taking unfair advantage for their monopoly positions, the law prohibited them from entering the competitive markets.

At issue is whether batteries, which would send power onto the grid, would put utilities into the generation business and violate state law. That question has come up in the ongoing rate case of the Houston utility CenterPoint Energy, which asked the state Public Utility Commission for permission to install battery technology to handle intermittent voltage losses from solar farms, wind farms and other forms of distributed power.

Regulators, however, have opted not to debate the issue, instead punting it to the Legislature to determine whether utilities should be allowed to install batteries.

Dependable source

Demand for batteries in Texas got a boost this summer when prices skyrocketed to $9,000 a megawatt hour, the state maximum. A few minutes of $9,000 power is enough for generators to make millions in profit, according to energy experts, making it even more attractive to find more ways to store power for a few hours and then sell it when prices surge.

Battery storage is also growing in other states. The Federal Energy Regulatory Commission directed regional grid operators outside Texas last year to revise their rules to make it easier for battery storage to participate in the market.

The rule, however, is being challenged in court by investor-owned and municipal utilities, which sued FERC in the U.S. Court of Appeals in Washington in July to overturn the commission’s order, contending that battery storage systems are unpredictable and would impose too much expense on grid operators. The case is pending.

Meanwhile, the power industry is moving to add more storage capacity to the Texas grid, momentum aided by falling battery prices, ERCOT’s efforts to incorporate batteries into the grid, and new wind and solar developments. Ultimately, these intermittent power generators could become a dependable source of inexpensive and clean power for the growing Texas economy and population.

“A battery,” said Mark Bruce, chief product officer for Grid Monitor, a data research firm in Austin, “can make solar more like a gas combustion turbine.”