Fraud-hit CG Power and Industrial is looking to bundle its overseas assets into a separate entity to sell it to strategic investors. The manufacturer of power and distribution transformers is valuing its global assets at around $250 million, three people with direct knowledge of the development, said.

“CG Power has held talks with some Japanese and European companies for the same,” said a person with direct knowledge of the development. “It (sale of some of the overseas assets) will be purely used to settle some of the overseas debt and payables,” said another person involved in the process.

CG Power’s product portfolio includes transformers, switchgear, circuit breakers, network protection & control gear, project engineering, HT and LT motors, drives, power automation products and turnkey solutions in all these areas.

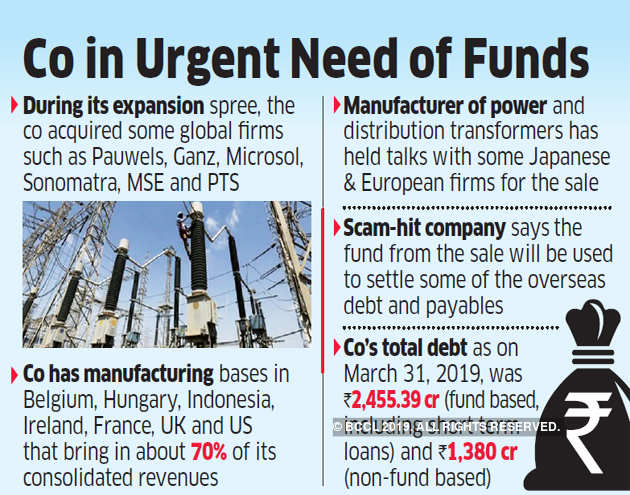

During its expansion spree, the company acquired some international companies across the world such as Pauwels, Ganz, Microsol, Sonomatra, MSE and PTS. It has manufacturing bases in Belgium, Hungary, Indonesia, Ireland, France, UK and US that bring in about 70% of the company’s consolidated revenues.

The corporate affairs ministry’s Serious Fraud Investigation Office (SFIO) has initiated a probe into 16 entities of the group including CG Power, news reports said earlier this month. In August, the board of CG Power said it would restate the company’s accounts after it discovered “significant accounting irregularities” and alleged governance lapses.

Gautam Thapar, the promoter and chairman, was removed by the board and efforts are ongoing to reduce debt, sell non-core assets and restart and optimise operations.

A spokesperson for CG Power declined to offer any comment for this story.

The total debt on the books of the company as on March 31, 2019, was Rs 2,455.39 crore (fund based, including short term loans) and Rs 1,380 crore (non-fund based).

“Keeping in view the existing borrowing and additional fund requirements and given the current financial condition of the company, it is in urgent need of both long-term and working capital and towards this, the management of the company is in the process of identifying potential sources of capital,” the company said in its note to exchanges seeking shareholder nod to raise up to Rs 5,000 crore of borrowings.

The company is also seeking external advice on the mode and sources of fundraising. “Hence, approval of the members (or shareholders) is sought for availing borrowings up to an amount of Rs 5,000 crore for meeting the immediate funding requirements of the company,” it said.

The company is looking to repay its loans in another 18-24 months.

To understand the extent of the alleged fraud, three independent forensic audits have been commissioned by the Securities and Exchange Board of India, Reserve Bank of India and the board.

“The entire liquidity of the company was sucked out. Our efforts are on to pump in liquidity in the company,” Narayan Seshadri, an independent director and now one of the custodians overseeing the company’s resurrection, said in a recent interview with ET.

The company’s equity investors — mutual funds, KKR, L&T Finance, Sunil Bharti Mittal Holdings and Special Situation Funds, among others — have given an informal nod to strategic sale of assets to raise capital. SBI Capital Markets, the investment banking arm of State Bank of India, is mandated to look for buyers.