One form of cognitive disorder seems to be taking over the observers of the oil market, a blind belief that shale oil production in the United States will grow and grow indefinitely at an aggressive rate. This erroneous belief Then, it is undeniable that the growth of shale gas in the United States has been amazing in the past few years, and the geological and financial resources of the US shale oil industry are not unlimited.

Post the OPEC+ meeting in early July, a host of market commentators lampooned OPEC+ for pursuing a policy of strategic patience. On July 2nd the Financial Times published an article under the somber heading: “OPEC is stuck in a production-cutting cycle it cannot get out of”. On July 3rd, CNBC published a similarly ominous prediction: “Defensive OPEC alliance has ‘no clear endgame’ in an era of abundant supply, expert says.” On July 4th, The Economist published a critical article under the title: “OPEC’s Predictable deal cannot hide its giant problems.”

The thrust of the above articles, as well as many others like them, is this: US shale oil growth is virtually unlimited and OPEC is fighting for a lost cause. This kind of narrative is attractive to many, for OPEC represents much of what the west dislikes: Many of OPEC’s autocratic members have had a confrontational relationship with the west at one point or another, and OPEC’s founding objective of managing oil supply is antithetical to the western ideal of free markets. Although, considering the current level of western governments and central banks market intervention, one wonders if the latter remains a concern. To make matters worse, the fact that Russia, the West’ classic nemesis, is playing a supportive role to OPEC has only made the organization that more off-putting.

is OPEC truly losing the shale war?

Wishful thinking aside, is OPEC truly losing the shale war? Is OPEC really stuck in an endless supply cutting cycle it can’t get out of? To answer these questions, one must define what constitutes winning? Do we measure winning by market share? Revenues? Profits? Reserves? Reading the aforementioned articles, the overwhelming measure for success seems to be production levels and market share. Not withstanding the obvious flows in focusing exclusively on production regardless of financial returns, lets examine data from a production level standpoint:

In 2014, prior to the shale induced oil price collapse, OPEC produced 30.6M barrels per day (OPEC Annual Statistical Bulletin). In Q1/19, OPEC produced 30.4M barrels per day (OPEC MOMR). A cursory review of the data indicates that OPEC has barely reduced its production since 2014. Furthermore, if one were to exclude Venezuela and Iran from the calculation due to US sanctions, one would notice that OPEC production actually increased during this period from to 24.8M bpd to 26.8M bpd, or a 2M barrels increase. In terms of market share (excluding Venezuela and Iran) OPEC market share actually increased from 26.8% in 2014 to 27.1% in Q1/19. Thus, one wonders as to the veracity of the research underpinning much of the press critical of OPEC.

Since 2017, having tried and failed to destroy US shale in 2015/2016, OPEC in collaboration with Russia, has been pursuing a very shrewd strategy of opening a path for US shale to claim a slice of the market with minimal market disruption possible. Many of OPEC’s critics seem to believe OPEC’s lacks a long-term strategy, but this is far from accurate. As a matter of fact, the Saudi oil minister, Al-Falih, said as much on July 1st: “I have no doubt in my mind that U.S. shale will peak, plateau and then decline like every other basin in history.” In December 2018, Russian energy minister, Alexander Novak, took a similar position by voicing doubt as to US shale ability to grow in the medium term.

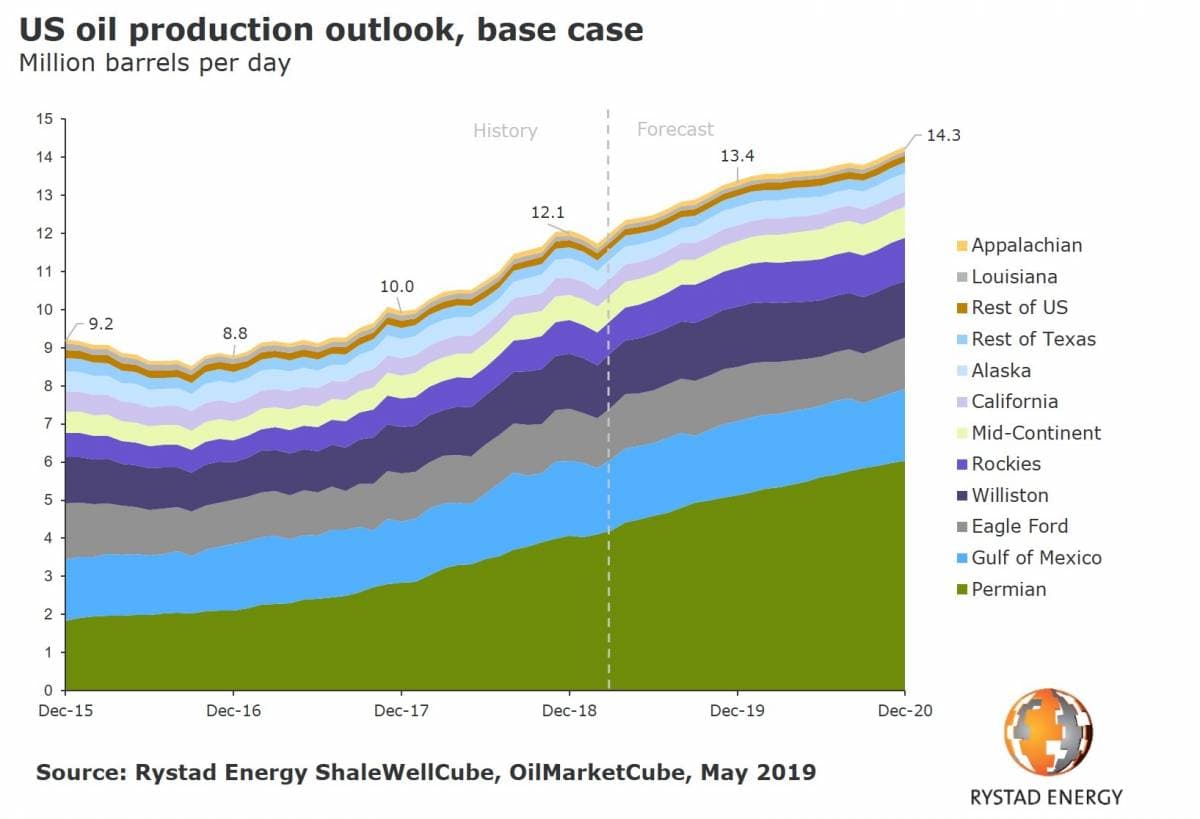

Basically, OPEC and Russia are planning to wait out the strong growth phase in US shale, and the reality is they probably don’t have to wait too long. US shale growth due to a host of geological, financial and logistical factors is set to slowdown in the early 2020s. Rystad Energy, one of the staunchest believers in US shale, is expecting US production growth to slowdown meaningfully as early as next year:

After having grown by 2.1M bpd in 2018, Rystad expects US oil production growth to slow to 1.3M bpd in 2019, followed by another slowdown to 900K barrels bpd by 2020. Said another way, Rystad expects US oil production growth to slow by 60% between 2018 and 2020. Rystad is not alone, the EIA, in its latest STEO, is forecasting US crude production growth to slow from 1.4M bpd in 2019 to 900K bpd in 2020, or a 35% decrease in the growth rate in one year. The IEA is no different, its expectating a slowing in US liquids growth from 1.7M bpd in 2019 to 1.3M bpd in 2020. The trend in all these forecasts is unmistakable: US production growth is set to deaccelerate sharply from 2020, and it will only get worse down the line as the sheer size of US oil production, and the industry persisting inability to generate positive cash flow, makes sizable production growth ever harder to sustain.

Nothing captures the demoralized spirit of US shale producers as Scott Sheffield, CEO of Pioneer Natural resources, back in 2014, Mr. Sheffield claimed that Pioneer would produce 1m barrels of oil equivalent by 2024. Last month, Pioneer’s CEO walked back this lofty goal in an interview with the Wall Street Journal. Today, no reference is made to the one million goal in any of Pioneers’ investor slides after many such references were made in the past several years. Recently, Steve Schlotterbeck, former CEO of EQT labelled the shale gas revolution as an “unmitigated disaster” while listing a total of 172 North American E&P companies, with nearly $100B in debt, that filed for bankruptcy since 2015, as well as, highlighting the 80% loss of value for the remaining key players. Echoing Mr. Schlotterbeck, Scott Sheffield at Pioneer Natural Resources said to this WSJ, “We lost the growth investor, now we’ve got to attract a whole other set of investors.” (Translation: Now that we’ve lost the confidence (and the money) of the first group of gullible investors, we need to find a new set of naïve investors.). Over the past 10 years, 40 of the largest independent oil and gas producers collectively spent roughly $200 billion more than they took in from operations according to the Wall Street Journal. Pierre Andurand, one of the world’s foremost oil traders, pins the US E&P industry overspend at $300 Billion since 2006, and the industry enterprise value destruction at half a trillion dollars since 2003.

Despite all the above, US shale production is unlikely to decline or even stall anytime soon, especially now that the super majors such as Exxon and Chevron having moved into the Permian. However, what’s clear, and what truly matters to OPEC (and Russia) is not the absolute level of US production growth as much as the rate of that growth. Multiple datapoints and a host of reliable forecasters signal an impending flattening in US shale production growth, and as that flattening takes place, OPEC will claim ownership of the oil market once more.

Conclusion

While, the US shale industry has grown its production significantly since the oil price collapse in 2014, OPEC’s core members have managed to protect and grow their market share. Most importantly, the surge in US oil production has drowned the US E&P industry in red ink: close to 200 E&P companies have filed for bankruptcy and hundreds of billions of dollars in US energy stocks market value have been lost. Furthermore, the E&P industry has lost access to the debt market and equity markets, meanwhile industry insiders are being forced to admit their mistakes, change their ways and walk down their rosy production forecasts. Ed Morse, head of Commodities Research at Citi bank, had this to say about OPEC’s decision to extend its production cuts:

“The countries involved have no clear endgame other than to push back the inevitable time in which the age of supply abundance can no longer be held back.”

Its hard to know whether Mr. Morse, a respected market veteran, truly believes in his own statement. The OPEC+ policy of awaiting a projected flattening in US shale growth is the literal definition of an end game. As to the “abundance of supply”, it is not as much of oil as it is of cheap capital, and now that Wall Street has closed the money spigots, the illusion of unlimited US shale growth is soon to be shattered.