On site power generation, battery storage and microgrids have emerged as a way to to increase the use of renewables, to enhance resiliency and to reduce the cost of providing energy. Other benefits include less wear-and-tear on the centralized delivery system and perhaps a reduction in future transmission projects, along with avoiding the cumbersome permitting process associated with large energy projects.

The research firm’s new report also includes energy storage, demand response, electric vehicle charging and energy efficiency in its definition of distributed energy resources.

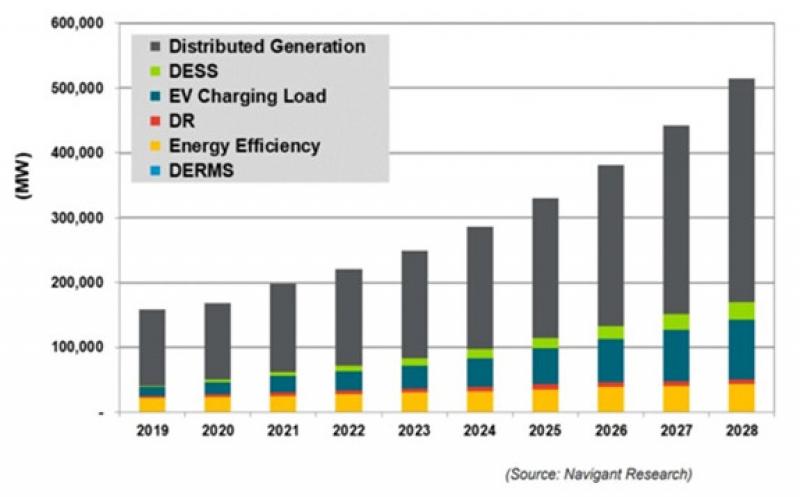

Annual Installed Total Distributed Energy Resource Power Capacity by Technology, World Markets: 2019-2028

“In many markets, it is simpler to have distributed energy resources, especially solar-plus-storage,” says Roberto Rodriguez Labastida, senior research analyst at Navigant Research, in an interview. “The growth will continue — based largely on sustainability needs and economics: Now you have a system at the facility that can provide a similar service at the same or lower cost than the grid.”

The new Navigant report is called “Global DER Overview: Market Drivers and Barriers, Technology Trends, Competitive Landscape and Global Market Forecasts.”

The report forecasts 158.3 GW of distributed energy resources capacity in 2019, hitting nearly 345 GW by 2028. Of that, about 245 GW comes from solar PV installations while almost 93 GW comes from electric vehicle charging stations.

The revenues associated with that expansion? In 2019, the research firm says that it will be $172.5 billion and in 2028, it will likely reach about $650 billion at a compounded annual growth rate of 15.9%. Distributed generation will claim most of that revenue, or $131 billion in 2019 and $527 billion in 2028 — with about $480 billion of that 2028 figure coming from distributed PV installations. Energy efficiency is expected to generate about $28 billion in 2019 and $58 billion in 2028, the report says.

Without a doubt, there are some market barriers. They include limited customer awareness, a fragmented value chain and a costly communications infrastructure. The study also says that there is a need for comprehensive financial models — to indicate to the market that investments in on-site generation and microgrids are feasible.

“In the beginning, distributed energy resource assets were heavily subsidized,” says Navigant’s Labastida. “They now need less government support to continue growing. The cost of the technologies are continuing to fall and especially solar-plus-storage. The market is price conscious — and that includes the residential and commercial and industrial segments, both of which will grow significantly.”