The government intention to gasify at least 100 million tonnes of coal across industries -- fertiliser, steel, chemicals and power – will be a big leap forward for use of new technologies and for reducing coking coal imports, says VR Sharma, MD, JSPL. Excerpts from his interview with ET NOW.

Dedicated mines for coal gasification will be game-changer for us: VR Sharma, MD, JSPL

Dedicated mines for coal gasification will be game-changer for us: VR Sharma, MD, JSPL We were having an interesting debate that if 3D printing is back, what will happen to steel and cement demand. That is a disruptive trend in the making for steel and for cement.

Traditionally, steel and cement are core sector industries. Barring a few months in a year, normally steel comes back and so does cement. But we feel the market is in a downturn. Traditionally, these are basic ingredients of the construction industry as well as for the auto and engineering goods, for machine building, ship building and railways. Steel has its own merits over other products. We are looking at a better tomorrow. We have started the New Year with better demand, better prices. So, we are very positive on the current situation.

Let us touch upon steel prices as well. Companies have been waiting for this and we are hearing that some have increased prices by 8-9 per cent in last three months. Is that the case with JSPL?

Yes, this is the case for all across the country, as well as globally. If you look at international prices for scrap, they have gone up. Pig iron prices have gone up. HBI, DRI prices have gone up. All metallics have gone up. Similarly, steel prices worldwide have gone up. So is in India. We are looking at 10-12% growth in overall steel prices going upward. It was long due and the New Year has started with a lot of hopes. We are hopeful the industry will revive and there will be momentum at all levels – end-users, consumers, customers.

What is the price differential you see between flat and long products?

There is hardly any difference now, because long and flat products are almost same. Ex-gate prices, we call it NSR, are around Rs 36,000 for both the items. So, there is no difference. There can be a difference on a regional basis, where freight plays a vital role. Most of the plants are in the central or eastern parts of the country. If somebody wants to buy somewhere in Kolkata or Bhubaneswar, prices will be a little lower because of the freight, but in Chennai, Kerala, Bangalore or up north into Delhi, they will be a little higher.

Can you tell us a little bit about the CGP plant. How will it ramp up the Angul DRI production? Is it going to help increase overall productivity?

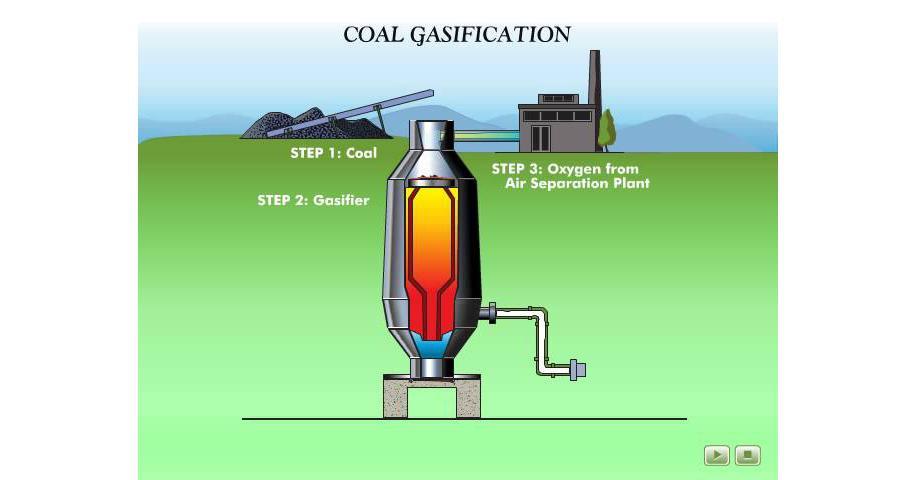

Yes, it is a very good news. The CGP plant has been restarted. This is a coal-to-gas plant and it is fading now. It’s the first gas-to-DRI plant in the world based on coal gasification, which is called Syngas or the synthesis gas. This plant was commissioned in 2014. Intermittently, we have been running this plant because coal was not available and we did not have the mines. It needs coal of a consistent quality. Of late, we have started getting coal from Mahanadi coalfield as part of Coal India. We are getting coal in good quantity and buying it in open auction to restart the plant. This is a very sophisticated plant and capacity is 225000 mt per hour and we can produce about 1.8 mt of DRI, which will be equal to about 1.5 mt of steel per year.

If you do not get necessary mines for which you have been fighting, how will life change?

If we get the coal mines, nothing like that. Reason being, we need coal of consistent quality. Today we are buying coal from MCL or Coal India, which comes from different mines. So quality is always different. We wash the coal and then use it in the furnace. We still request the government to allocate a dedicated mine to us, so that we can work uninterrupted. This is what we are expecting. I think with the new policy, the government will definitely come out with coal allocation or mining allocation to gasification units or DRI units or some other similar steel plants interested in such technologies.

End user restrictions in coal auctions have been done away with. Talk to us how this will benefit you?

We are buying coal through auction. So today, the price is workable and we feel the Prime Minister is saying that Coal India has been given a target of 1 billion tonnes of coal auction per year of production. Steel Minister Mr Pradhan also explained that the intention is to gasify at least a 100 million tonnes of coal across industries -- be it fertiliser, steel plants, or other chemical units or power plants. If it comes true, this will be a good move by the government on coal gasification and to enter into petrochemicals, to enter to into fertilisers, to enable steel mills to produce DRI, and finally, to produce power, so that steel mills can depend on DRI plus electric arc furnace routes instead of the blast furnace route where we need to import coking coal.

More than 90% of the coking coal in the country is being imported today. So I think this is the best technology to utilise Indian grade coal, convert it into syngas and then use syngas to produce DRI. This is the technology of tomorrow. Sooner or later, other industries will also adopt this technology, because they have been watching for a long time what is going to happen with the quality, the process, parameters and functioning of DRI plants which we have already demonstrated to the whole of the world. This is the first plant in the world based on coal gasification.

Production also has reached record highs. What is the capacity you are operating at in Angul and also in Raigarh?

At the beginning of the year, we had an annual business plan to produce 6.5 million tonnes in India and 2 million tonnes in Oman. We will cross 6.5 million tonnes this financial year and we will also cross the 2 million tonnes figure in Oman. From next financial year, the addition of this DRI will give us another 1.5 million tonnes, raising it to about 8 million or maybe 8.2 million tonnes in India next financial year and we will be aiming for 2.4 million tonnes from Oman. So our aim is to reach to 11 million tonnes by the end of financial year 2020-21.