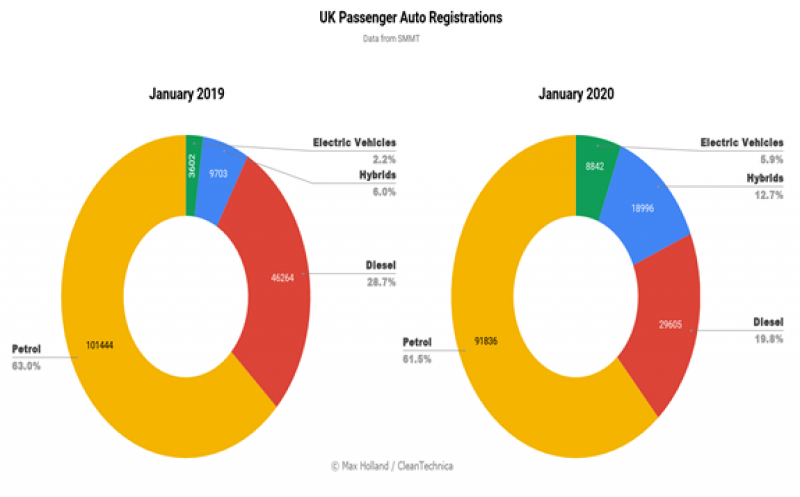

UK combustion vehicle sales fell 18% year on year in January as plug-in electric vehicles took almost 6% of the market, up from 2.2% a year ago. Diesel sales were hit particularly hard, selling 36% less volume than January 2019. Will the UK government’s recent target of phasing out combustion vehicles by 2035 be overtaken by consumer preferences?

The UK EV mix in January was well balanced between full electrics (2.7%) and plug-in hybrids (3.2%). The growth in EV market share occurred despite last year’s top selling EV, the Tesla Model 3, not yet having been shipped to the UK for 2020 sales.

In fact, without the Model 3 being available in any volume, no individual EV entered the top ten best selling UK autos in January. The Model 3 has frequently been in the UK top 10 list in recent months, hitting #3 in August.

On the other hand, the fact that the EV market share was still strong despite no individual model being sold in very high volume last month suggests that a broad mix of EV models supported the category result. The market is maturing.

MG Motors noted that the ZS EV was the brand’s overall best selling UK model in January, giving MG its highest ever monthly sales (1,846 brand sales in total), but MG Motors didn’t provide specific numbers for the increasingly popular EV.

Traditional hybrids and mild hybrids also saw a good boost of sales in January, progress that’s visible in the above chart (“Hybrids”), but we don’t count these as EVs, since they ultimately get all of their energy from fossil combustion, and associated pollution. Hybrids without plugs are largely a temporary stop-gap to slightly reduce business-as-usual emissions, and prolong the life of combustion engine technologies.

Their growth this year will help the non-plug-in fleet’s average consumption get closer to the 95 g/km overall CO2 target for 2020. However, as emissions targets tighten further throughout this decade, only plug-in vehicles that can cover average commuting distances (around ~50 km / ~30 miles) on pure electric power will suffice. This is especially the case with the WLTP and RDE emissions tests now active, as these are based on a ≥48 km mixed driving cycle.

We’ve just seen France, Norway, and Germany delivering record EV performances in January, with Sweden, Spain, Italy, and other European regions also making giant strides. Europe as a whole looks likely to have achieved around ~8% EV market share in January. We’ll know more once all the registration numbers are in.

The UK was at 3.1% EV market share for 2019 as a whole, but hitting 6.3% in December and maintaining almost 6% in January, it looks like things have stepped up a notch. The market is potentially closing in on 10% monthly market share result at some point later this year. Based on reliable adoption trajectories from leading EV nations, that will keep accelerating.

How long will it be before UK folks just lose interest in buying combustion vehicles altogether? The government recently set an end point of combustion vehicle sales by 2035, but it is open to pulling the deadline closer depending on events on the ground. At the rate things are moving, I’d guess that over 80% of UK vehicle sales will be EVs by the end of this decade. Do you agree? Please jump into the comments to share you thoughts.