The impact on demand growth has been staggering, if not unprecedented, with February’s crude demand dropping by a shocking 4.6 million barrels per day (bpd), led by a 2.9 million bpd month-on-month drop in Chinese crude runs.

Rystad Energy’s pre-coronavirus global oil growth estimate was 1.1 million bpd for 2020, which we later slashed by 25% last month. Our data now point to a much more pessimistic outcome, with growth likely to fall to merely 500,000 bpd, and this is assuming that the Covid-19 epidemic will largely be contained by the end of June, which in turn implies a further downside risk.

OPEC ministers are meeting in Vienna 5-6 March 2020 to decide if the oil-producing block will bite the bullet and step in by cutting production in order to balance the supply-demand gap and shield oil prices. Rystad Energy sees that as an unlikely outcome.

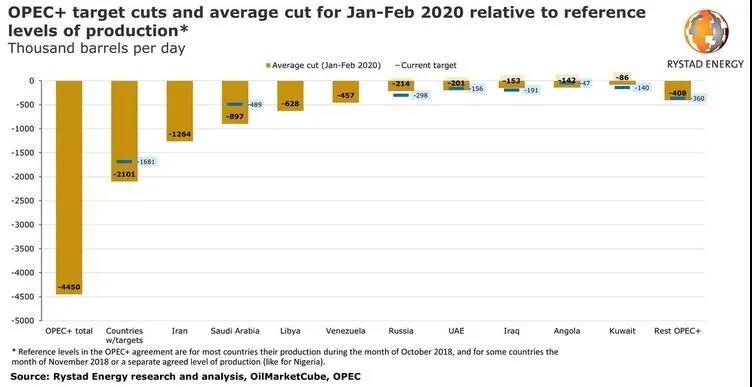

“We have modeled out three likely outcomes of the OPEC+ meeting, and not a single one of them comes close to bridging the supply-demand balance. Even though OPEC+ is already tremendously over-complying on cuts agreed upon in Dec-19, it’s not enough to counter the demand destruction of Covid-19,” says Bjørnar Tonhaugen, Rystad Energy’s Senior Vice President, Head of Oil Markets.

At least 2 million bpd of supply needs to be removed from second quarter balances in order to see a stabilization in oil prices, if Libya’s shut-in 1.1 million bpd production comes back online. The supply overhang from the first quarter will also have to be worked down before a recovery in price can manifest, adds Tonhaugen.

Learn more about oil demand in Rystad Energy’s Oil Market Update report.

A proposal for a total 1.5 million bpd cut was agreed on by OPEC producers at today’s meeting ahead of negotiations with Russia and non-OPEC-10 tomorrow. Under this proposal, OPEC would reduce output by 1 million bpd in the second quarter and the non-OPEC-10 group would be responsible for the remaining 0.5 million bpd.

At the moment, this is so far just a proposal formed only by OPEC members. It may or may not be approved on 6 March 2020 with the blessing of Russia and other OPEC+ members.

In our no-deal scenario, which is the least likely of the three, OPEC does not agree on additional cuts and extends the current production agreement through 2020. Such a development would imply a huge surplus of 1.8 million bpd for liquids in the second quarter of 2020, and 1.9 million bpd for crude, which could send Brent prices as low as $40. In all of our scenarios, Libya’s production is assumed to return to its normal 1.2 million bpd in Apr-20.

Deepening the cuts is a more likely outcome and we have two scenarios for an OPEC deal.

In a low-level compromise, production cuts are only increased by 0.6 million bpd in the second quarter on top of an extension of the current production agreement, we see the stock of liquids building at 1.3 million bpd and crude at 1.5 million bpd. Brent would see continued downwards pressure and test the $50 mark quickly, with low 40s Brent prices a probability in the second quarter.

In the scenario aligned with OPEC’s proposal, production cuts are extended by 1 million bpd in the next quarter, on top of the current agreement’s extension. Large stock builds are still inevitable, with liquids reaching 1 million bpd and crude 1.1 million bpd for the quarter. Brent would continue to see downwards pressure with the $50 mark threatened when Libyan production returns, but the deterioration in oil prices may be halted in this scenario as long as Libyan output remains shut-in.

The suggested non-OPEC-10 cuts of 500,000 bpd are not included in the above stock build calculations because even if these countries sign off on the new quotas, we believe they are unlikely to fully abide by the commitment and cut 200,000 bpd at most. In such a case, stock builds would be further reduced by the same amount.

The OPEC group has now put immense pressure on Russia for tomorrow’s meeting, which may find the burden is too large to swallow amid the risky demand backdrop, uncertainty over when Libya’s 1.1 million bpd of offline production returns, and the growing amount (7.2 million bpd in Feb-20) of offline capacity, volumes which could partially snap back onto the market in the near-term.

Rystad sees supply continuing to surge in countries that are not bound by any production quotas – namely in the US, Brazil, Norway, and Guyana.