Falling Production.

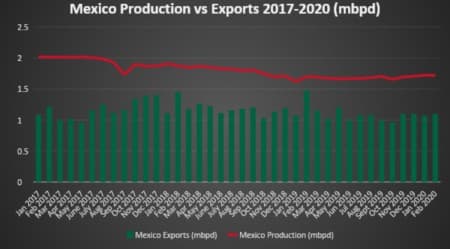

For 15 years already, Mexico has been struggling to reverse a seemingly terminal production decline.

When President López Obrador came to office, he vowed to fulfill one of his main campaign promises to bring oil production to 2.7mbpd by 2024. Yet one and half years into AMLO’s tenure and Mexican crude production continues to decline – currently at 1.72mbpd, down almost 15 percent in just 3 years – and given how strained relations are with international upstream investors, there is little hope to believe that the upcoming months will bring about any significant change. Mexico in general and PEMEX in particular have means to mitigate losses, however the extent thereof seems somewhat inadequate.

PEMEX’s traditional annual hedge, oftentimes presented as some sort of magic wand against market turbulence, will only yield some 300 million this year. This is primarily because the PEMEX hedge only covers some 20% of crude exports, having been fixed at a price of 49 per barrel from December 2019 to December 2020. There exists a separate Finance Ministry oil price hedge, the details of which remain classified – the Mexican authorities have repeatedly stated that these put options can fully compensate for any missing government revenue. Essentially, PEMEX is certain not to recover all of the short-received revenues which is quite troubling on the back of “Black Monday” (April 20) sending the Mexican crude basket into negative territory on the back of WTI pioneering its way there.

Internal Pressure.

Merely a couple of weeks after the OPEC+ was concluded, the Mexican oil regulator CNH (Comisión Nacional de Hidrocarburos) has stated it would seek a formal explanation from PEMEX on how it intends to carry out the 100kbpd production cut. One would presuppose that a decision to cut output would be of concerted nature, however in Mexico it resulted in a chaotic situation in which no one really understands who should lead the mandated curtailments, PEMEX or the Energy Ministry itself. The irony of it all is that Mexico only committed to 2 months of production cuts in May-June 2020, despite the general OPEC+ agreement charting the global course until April 2022; moreover the United States took up an additional 250kbpd of ‘’Mexican” output commitments to facilitate the deal.

Financial Difficulties.

PEMEX has in a way become hostage of its own importance – as oil companies across the world cut capital expenditures for 2020, PEMEX is pretending it can carry on with its assumed $16.7 billion budget for the year. Obviously this did not go unnoticed with market watchers; if PEMEX does not react appropriately then the Mexican NOC will burn most if not all of the credit facilities available and still end up with a $10 billion shortfall. With an aggregate debt level of $105 billion, this is certainly no good news - the Mexican NOC has posted an unprecedentedly high loss last year at $18.3 billion, almost doubling year-on-year despite increasing oil prices.

Shattering of Dos Bocas Refinery.

The low price environment and poor financial situation might push the Mexican government to scrap or postpone the construction of the planned 340kbpd Dos Bocas Refinery in AMLO’s home state of Tabasco, assumed to become the largest and most sophisticated in Mexico. The pet project of the embattled President has a hefty price cost of $8 billion and has been at the forefront of López Obrador’s struggle to end import dependence on US refined products, with an assumed commissioning date of 2023. There seem just to be way too many reasons pointing against the completion of Dos Bocas – no usable finances left, depressed gasoline prices, the Mexican peso’s recent depreciation, the botched bidding process and consequent inevitability to have a go at it by themselves.

Inadequacy of Measures Taken Heretofore.

Following the crude market’s “Black Monday'' on April 20 when US futures dived into negative territory for the first time ever, the agreed OPEC+ production cuts have already attested their insufficiency. The Mexican crude basket has dropped below PEMEX’s breakeven costs (of some $14 per barrel, according to 2019 data) to the lowest point in the whole of the 21st century. The coronavirus pandemic has made it really hard for the Mexican government to invest additional funds into PEMEX as reviving the virus-ridden economic life is a tangibly more important objective. Thus, PEMEX will have to find solutions by itself and find them relatively quick – investments beyond 2022 look increasingly problematic. Mexico’s offshore half-cycle costs are oscillating in the $25-30 per barrel interval and with the current price environment even brownfield investments are questionable.