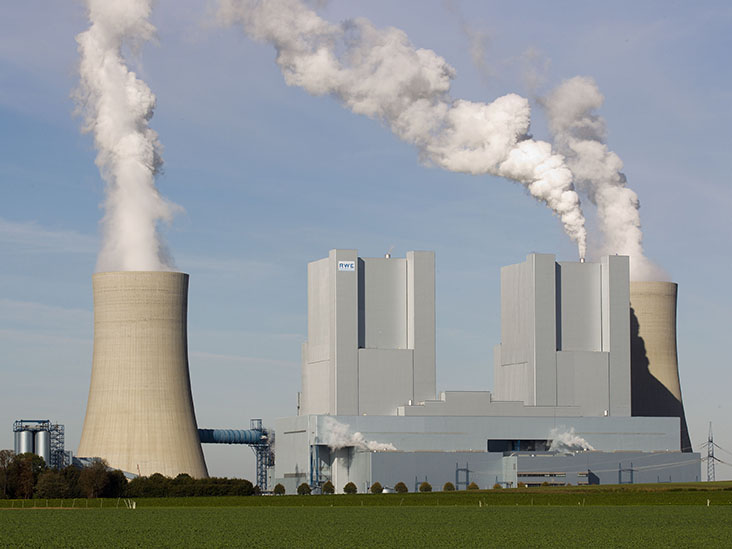

Lignite-based power generation at German utility RWE has dwindled 4.9 TWh, or 36%, year on year in 2020’s first quarter, with the firm attributing the fall to low power prices, it said late on Thursday.

Output from its German lignite fleet plunged to 8.6 TWh, from 13.5 TWh during the first quarter of 2019, preliminary generation data showed.

Production had also been curbed by the transfer of its Neurath C (292 MW) unit into the country’s lignite reserve in October last year.

Similarly, lower prices and the decommissioning of the 614 MW Gersteinwerk K2 unit had hit RWE’s German hard coal-fired output, which plunged 1.2 TWh, or 60%, to 0.8 TWh for the January-March period.

For the group overall, hard coal-fired generation was down 3.4 TWh, or 63%, year on year to 2 TWh, also due to market prices, the decommissioning of the UK’s Aberthaw plant (1,560 MW) and conversions to biomass in the Netherlands.

Gas generation falls

Gas-fired generation, meanwhile, was down 0.9 TWh to 11.7 TWh, driven by a 3.1 TWh – about 34% – plunge to 6.1 TWh in the UK due to “less demand in Q1 2020 due to warm and windy weather and Covid-19 impact in March”, it said.

However, gas-fired generation rose from 1.5 TWh to 2.6 TWh in the Netherlands amid the restart of the 1,304 MW Claus plant and in Germany by 0.2 TWh to 1.9 TWh.

A rise in CO2 prices has hampered profit margins for lignite-fired plants, which are among the worst emitters of the greenhouse gas. At the same time, prices for gas have fallen to record lows, improving the lower emitting fuel’s competitiveness compared to lignite and hard coal.

The clean dark spread, a measure of profit for burning hard coal to produce power, last stood at EUR 1.45/MWh for less efficient German units in Q3 and are negative for May and June. More efficient gas plants could see a clean spark spread – the equivalent for gas – of EUR 13.83/MWh in Q3 and EUR 4.48/MWh in May, according to Montel data.

Renewables output at group level trebled from 3.4 TWh in Q1 2019 to 9.2 TWh this year on the back of RWE’s takeover of Eon capacities in an asset swap deal finalised last year, the commissioning of new plants as well as windier, sunnier weather, it said.