The company’s solar irradiation maps show the impact relatively small fluctuations in global horizontal irradiation (GHI) are having on production during the current lockdown.

The recent record production figures in these key European solar markets have been driven by a number of factors, not limited to GHI levels. These include new capacity added in 2019 and reduced levels of air pollution. Low energy demand during the lockdown has also helped solar energy enjoy record high market shares in these countries.

However, with high GHI levels set to continue in summer, it is expected that solar resource will drive further production records in the coming months. The opportunity must be taken now to assess how future curtailment and price cannibalisation risks can be managed by the industry to ensure smooth integration of new capacity into the European grid. In particular, more robust resource forecasting will be needed to manage solar energy variability in future.

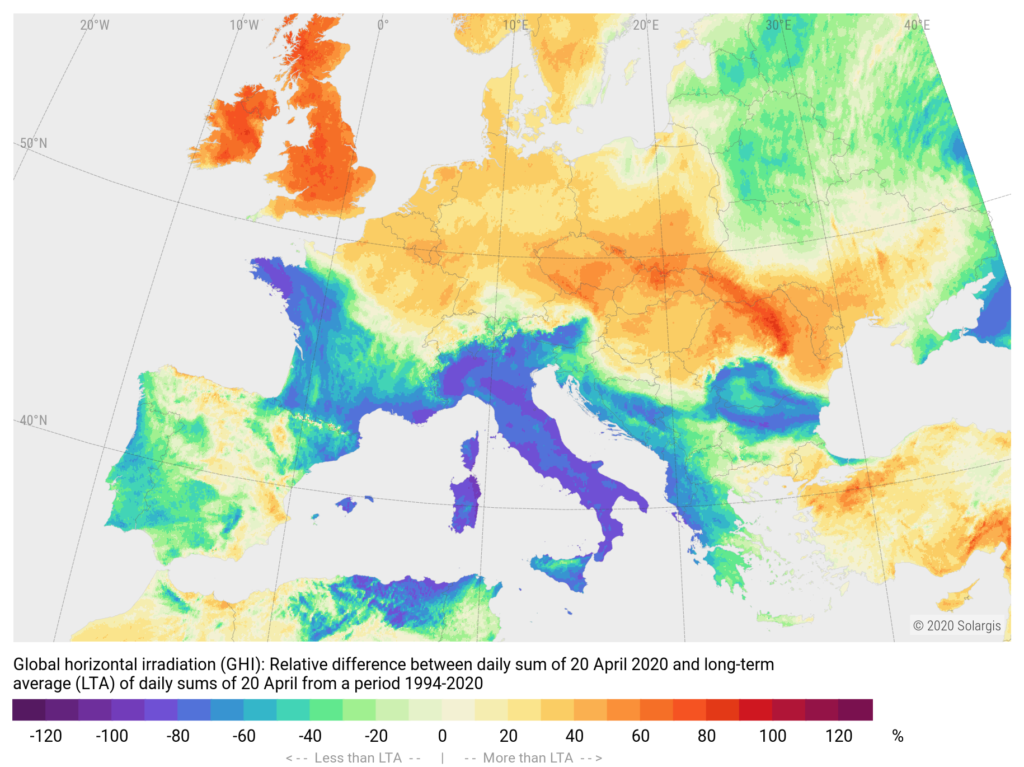

Solargis’ maps illustrate how daily solar irradiation varied from long term averages in the UK, Germany and Spain on the dates when the production records were set:

European GHI 20th April 2020 – difference from long-term average

European GHI 20th April 2020 – difference from long-term average

Spain broke its solar production record on 26th March, while the UK and Germany both broke their records on Monday 20th April. In the UK, according to historical records from the last 27 years, this was among the most sunny April days recorded. In Spain, daily GHI on the 26th March was up to 70 per cent above average in the northwest of the country, but saw a more moderate increase in other regions, suggesting that new capacity additions in 2019 had a significant role in the milestone 6.3 GW of power produced.

On April 20th, the UK and Germany benefitted from a combination of high GHI levels (70 per cent and 50 per cent above daily average, respectively) and low temperatures. UK solar set a peak production record of 9.68 GW, while German solar assets produced a peak of 32.2 GW.

Lower demand for electricity during national lockdowns has also led to higher proportions of solar energy in the European energy mix. In the UK, solar energy provided nearly 30 per cent of UK electricity demand while setting the production record – in Germany, the figure was 40 per cent.

These milestones are a positive development for solar energy, which currently enjoys a preferential status over conventional power sources in many European markets. However, a sudden surge in generation also creates challenges for the grid, and may lead to risks for portfolio owners such as curtailment of assets and negative market pricing.

“The current situation has handed national grids, policymakers and the solar industry a valuable opportunity to understand how this volume of renewable generation can be managed in future, when renewables are set to make up a much greater part of the energy mix,” said Marcel Suri, Managing Director, Solargis. “Most markets work on a target of 50 per cent renewables by 2030 – but many are approaching this already because of the combination of low demand during the lockdown and favourable weather.”

Solargis has highlighted that more needs to be done in the management of weather and resource risks – whether they lead to under- or overperformance. Current circumstances have underscored the need for accurate forecasting data, critical to understanding future portfolio performance and price risks. As the pandemic reconfigures government spending and so accelerates the move into a merchant market, it is vital that asset owners are able to understand how production will change in next hours and days.

“As the proportion of renewables in the European grid increases and we shift into a post-subsidy environment, accurate forecasting becomes increasingly essential for the operation of solar projects,” Suri added. “During this lockdown, the energy industry will have a greater opportunity to witness what curtailment and price cannibalisation look like in practice, and we anticipate that this will drive investment in more sophisticated forecasting and grid management approaches.”

April’s above average irradiation also highlights that shifting climate patterns may have an impact on the reliability of long-term resource estimates, placing greater emphasis on a better quality of data during development and financing. Many publicly available data sets are outdated, and do not have an appropriate level of granularity to inform solar investment.

Suri continued: “Reducing risk is a key part of maximising profitability throughout the lifecycle of a solar project, from the earliest pre-feasibility studies to accurate forecasting of returns during long-term operations. As a 1 per cent reduction in resource risk can increase return on equity by approximately 4 per cent for the investor, it is critical that solar asset owners can use the most accurate data to underpin their long-term strategies.”