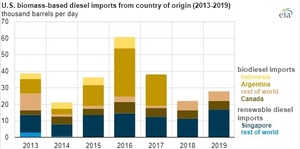

U.S. imports of biomass-based diesel, which include biodiesel and renewable diesel, grew 26 percent in 2019 to more than 27,000 barrels per day (b/d), reversing three years of decline. Imports of biomass-based diesel increased in 2019 because of the increase in renewable diesel imports from Singapore.

Biodiesel is a mixture of chemical compounds known as alkyl esters and is often combined with petroleum diesel in blends of 5 percent to 20 percent, or B5 to B20. Renewable diesel is composed of hydrocarbon chains that are indistinguishable from petroleum diesel, meaning that it meets specifications for use in existing infrastructure and diesel engines and is not subject to any blending limitations. Biodiesel and renewable diesel are produced from a variety of fats, oils, and grease, collectively referred to as FOGs.

Because biomass-based diesel typically costs more to produce than petroleum diesel, federal and state policies largely drive the consumption of biomass-based diesel. At the federal level, biomass-based diesel qualifies as an advanced biofuel under the U.S. Environmental Protection Agency’s Renewable Fuel Standard (RFS) program, which requires renewable fuels to be blended into the nation’s fuel supply.

Biomass-based diesel also generates credits under California’s Low Carbon Fuel Standard (LCFS) and is increasingly used to meet the increasing fuel standards in the LCFS because of its favorable greenhouse gas reduction score.

The majority of biomass-based diesel imports in 2019 came from renewable diesel imports—which have been sourced exclusively from Singapore since 2015—and rose 49 percent to a record of nearly 17,000 b/d in 2019. Since 2016, all U.S. renewable diesel imports have entered the country in California, most likely for compliance with the LCFS because renewable diesel has one of the lowest carbon intensities of the approved pathways for LCFS compliance.

Biodiesel imports from Canada accounted for the majority of the U.S. biodiesel imports in 2019, totaling 5,100 b/d, with the remainder coming from European countries. Biodiesel from Canada has regularly been imported into the United States to capture U.S. tax incentives and contribute toward U.S. renewable fuel programs.

Although increasing Renewable Fuel Standard (RFS) targets have driven biomass-based diesel demand in recent years, total imports have fallen because of decreases in imports from Argentina and Indonesia since 2017, the year the United States imposed import duties on biomass-based diesel imports from those two countries. Neither Argentina nor Indonesia exported any biodiesel to the United States in 2018 or 2019. Overall, U.S. imports of biodiesel totaled more than 11,000 b/d in 2019, about the same as 2018 levels.

The United States also produces and exports biodiesel, and Canada is a key trading partner. U.S. exports of biodiesel totaled 7,400 b/d in 2019, an increase of 10 percent from 2018. Canada received nearly 90 percent of the U.S. exports of biodiesel, much of which was produced in the Midwest, where most U.S. biodiesel production capacity exists. In 2019, the United States exported more biodiesel to Canada than it imported by approximately 1,500 b/d.

In its May 2020 Short-Term Energy Outlook (STEO), the U.S. Energy Information Administration (EIA) expects that continued growth in renewable diesel imports into California will lead to increased volumes of total biomass-based diesel imports, with net imports increasing by an estimated 25 percent in 2020 and by 56 percent in 2021. EIA expects domestic biodiesel production volumes in 2020 will be similar to those in 2019.